- Home

- >

- Daily Accents

- >

- Dollar, Equities Drop on Doubts Trump Can Deliver

Dollar, Equities Drop on Doubts Trump Can Deliver

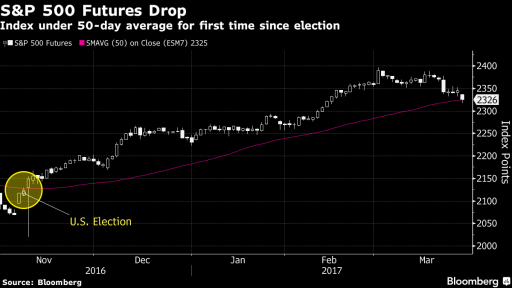

The dollar extended its decline and stocks fell as investor doubts grew that U.S. President Donald Trump will be able to implement his economic agenda.

The greenback was on the verge of erasing the rally spurred by Trump’s election victory, falling against all of its Group of 10 peers after the president and Republican legislators failed to proceed with health-care reform Friday. U.S. equity index futures suggested stocks would retreat for the seventh time in eight days, while European shares slumped. Oil slipped and iron ore futures paced losses in raw materials, while havens including the yen and bonds climbed.

Here are this week’s key events:

U.K. Prime Minister Theresa May will on Wednesday formally trigger the start of two years of Brexit negotiations with a letter announcing Britain’s planned withdrawal from the European Union.

Proposals to design and build Trump’s promised 2,000-mile border wall between the U.S. and Mexico are due March 29.

The U.S. Commerce Department will probably report that purchases rose in February at the same pace as a month earlier, indicating consumer spending is cooling in the first quarter.

Hungary, Mexico, South Africa and Thailand are among countries setting interest rates.

Samsung Electronics Co. will introduce its Galaxy S8 smartphone, the company’s first new mobile phone since the debacle with the Note 7 battery fires that led to its recall.

Chicago Fed President Charles Evans, who is a voter this year, speaks on economic conditions and monetary policy at an event in Madrid on Monday. Dallas Fed President Robert Kaplan, also a voter, is scheduled to speak Monday at Texas A&M University.

Here are the main moves in markets:

Asia

Chinese shares traded in Hong Kong fell 1.1 percent and India’s Sensex index slid 0.4 percent.

Stocks

Futures on the S&P 500 lost 0.9 percent as of 10:12 a.m. in London. The underlying gauge last week tumbled 1.4 percent.

The Stocks Europe 600 Index fell 0.6 percent as it was dragged down by miners and banks.

Currencies

The Bloomberg Dollar Spot Index fell 0.5 percent.

The yen rose 0.9 percent to 110.32 per dollar.

The euro gained 0.5 percent to $1.0857 and the British pound added 0.8 percent.

Bonds

Yields on 10-year Treasuries dropped five basis points to 2.36 percent, after giving up one basis point on Friday.

Commodities

Gold rose 1.1 percent to $1,257.28, heading for the highest close since Nov. 10.

West Texas Intermediate oil slipped 0.7 percent to $47.62 a barrel, erasing an earlier gain of as much as 0.7 percent. Crude producers pledged to consider extending their pact limiting supply.

Iron ore futures slid 3.9 percent, after briefly erasing gains for the year. The commodity surged in the opening weeks of 2017 following a surprise rally last year amid optimism about the demand outlook in China.

Copper fell 1.3 percent and tin dropped 2 percent.

Source Bloomberg

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.