- Home

- >

- Daily Accents

- >

- Dollar Jumps, Gold Falls as Demand for Havens Ebbs: Markets Wrap

Dollar Jumps, Gold Falls as Demand for Havens Ebbs: Markets Wrap

The dollar strengthened against its major peers and gold fell as demand for some haven assets ebbed. The weaker euro helped European stocks advance.

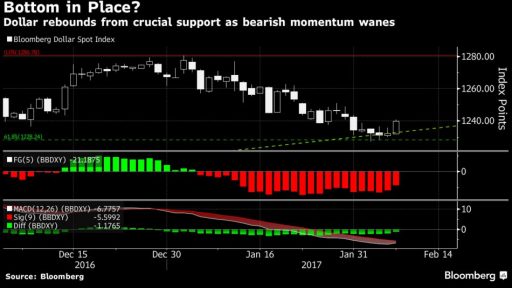

The Bloomberg Dollar Spot Index rose the most in almost two weeks after a member of the Federal Reserve indicated a March rate increase remains on the cards. The main equities gauge in Europe rose even as bellwethers BP Plc and BNP Paribas SA reported earnings that missed estimates. Gold slipped from the highest since November.

After Donald Trump spent the first weeks of his tenure in the White House taking swipes at other countries’ trading policies -- pushing the dollar to a two-month low -- investors are still holding out hope he will turn toward the spending and tax cuts he touted in his campaign. Across the Atlantic, political risk is pressuring the euro after French presidential candidate Marine Le Pen laid out a manifesto that included taking the country out of the common currency.

What’s coming up in the markets:

Central banks in India, New Zealand, Philippines and Thailand have meetings on monetary policy this week.

Trump’s administration returns to court today to defend the immigration ban, arguing the executive has broad authority to head off threats to the country

The U.S. Commerce Department is likely to say Tuesday that deficit in trade was little changed at $45 billion in December. The shortfall has been marked by weaker overseas sales of U.S.-made goods and stronger domestic demand for imported merchandise amid the dollar’s strong rally in the second half of 2016.

In the U.K., a report due Friday may show industrial activity moderated.

Scotland is taking its protest against Brexit to the next level with lawmakers in Edinburgh voting on whether to trigger the mechanism to leave the European Union. But the vote on Tuesday can’t stop Britain or even Scotland leaving the EU.

Currencies

The Bloomberg Dollar Spot Index gained 0.7 percent at 11:25 a.m. in London, rising for a second day. The euro dropped 0.8 percent to $1.0668 after sliding 0.3 percent on Monday.

The British pound retreated 0.8 percent to a two week low of $1.2373.

Stocks

The Stoxx Europe 600 Index climbed 0.4 percent, led by a 1.3 percent gain in the property sector.

Banking shares retreated for a second day after BNP Paribas SA posted fourth-quarter profit that missed estimates.

Futures on the S&P 500 climbed 0.1 percent after the underlying benchmark slid 0.2 percent on Monday.

Bonds

Yields on 10-year Treasuries were little changed at 2.41 percent after the biggest drop in more than two weeks in the previous session.

Greece’s two-year note yields neared 10 percent as a quarrel between the nation’s creditors over its fiscal targets boosted concern it is running out of time to complete yet another review of its bailout program.

Commodities

Oil slipped 0.1 percent to $52.86 a barrel after falling 1.5 percent on Monday before U.S. government data forecast to show U.S. crudestockpiles expanded for a fifth week.

Gold slipped 0.4 percent to $1,230.90 after advancing for three straight days to the highest level since November.

Nickel dropped from highest in more than three weeks amid uncertainty about Philippine supply. Industrial metals come under pressure in London from a stronger dollar.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.