- Home

- >

- Stocks Daily Forecasts

- >

- Don’t worry about higher interest rates for now, JP Morgan says

Don't worry about higher interest rates for now, JP Morgan says

You can stop worrying about the effect of higher interest rates on stocks for now, a J.P. Morgan strategist said Wednesday.

"While rising long-term rates will ultimately become a negative for profits and multiples, we do not see current levels as a reason to de-risk and sell equities," Dubravko Lakos-Bujas, head of U.S. equity strategy at J.P. Morgan, said in a note Wednesday. He also reiterated his S&P 500 target of 3,000.

Rising rates are good for stock valuations because they reflect underlying economic growth and inflation, which are both good for profits, at least initially, Lakos-Bujas said.

But U.S. stocks briefly entered correction territory earlier this month after concerns of rising inflation sent interest rates surging. On Wednesday, the benchmark 10-year U.S. note yield and the short-term two-year yield traded near multiyear highs. Last week, the Labor Department reported a much higher-than-expected jump in consumer prices for January.

Lakos-Bujas said he and his team view "normalizing inflation and declining global deflationary risks as a positive for equities at this stage of the cycle, and believe there has been some overreaction to inflation headlines lately."

The correction seemed to be driven by technical factors, he said, even though many traders and investors attributed the recent correction to inflation fears and rising rates.

Recent economic data have been strong. Last month, the Commerce Department said the U.S. economy grew by 2.3 percent in 2017, topping the 1.5 percent rate from 2016. Corporate earnings have also been strong. As of Tuesday morning, S&P 500 fourth-quarter earnings had grown by 15 percent on a year-over-year basis, according to Thomson Reuters I/B/E/S.

At these levels, it will take time for rising rates to present a problem for stocks, Lakos-Bujas said. "We don't believe equity de-rating is likely this year given expansionary fiscal policy, supportive global central banks, and attractive leverage and opportunity spreads."

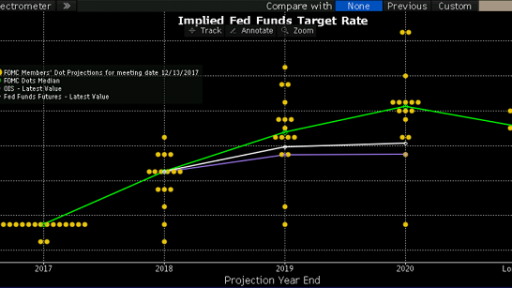

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.