- Home

- >

- Stocks Daily Forecasts

- >

- Dow drops more than 350 points in another bad day for struggling stock market

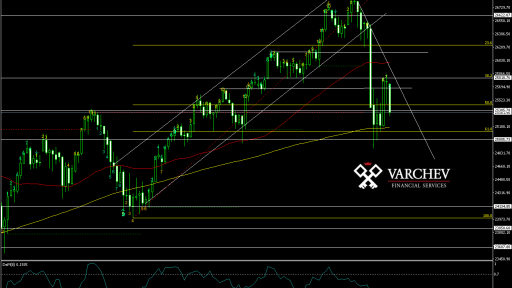

Dow drops more than 350 points in another bad day for struggling stock market

Stocks fell sharply on Thursday, continuing its October struggles.

The Dow Jones Industrial Average dropped 360 points, led by declines in Caterpillar and Apple. The S&P 500 fell 1.5 percent as the communications and tech sectors lagged. The Nasdaq Composite pulled back 2 percent. Overseas, China's Shanghai Composite dropped fell sharply.

Among the reasons for selling, according to investors, were the falling Chinese stock market, worries about a slowing global economy and a jump in Italian bond yields.

The Shanghai Composite dropped 2.9 percent and hit its lowest level since November 2014.

"Mr. Market is speaking loud and clear on China. The country is losing and needs to cry uncle," said Nick Raich, CEO of The Earnings Scout, in a note to clients.

"Chinese stocks are now at a four year low as rising U.S. interest rates and the likelihood of less favorable trade deals is going to adversely impact Chinese companies profits next year and its market price is re-setting lower to reflect that," Raich said.

This drop in Chinese stocks increased fears that China's economy, one of the largest in the world, could be slowing down, dragging down global growth. These worries increased on Thursday after European Central Bank President Mario Draghi said one of the risks for the economy was countries trying to circumvent EU budget rules.

Draghi's comments sent Italian bond yields to their highs of the day and sent major European stock-market indexes to their session lows.

Source: CNBC

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.