- Home

- >

- Stocks Daily Forecasts

- >

- Dow Jones – Good levels for Long positioning

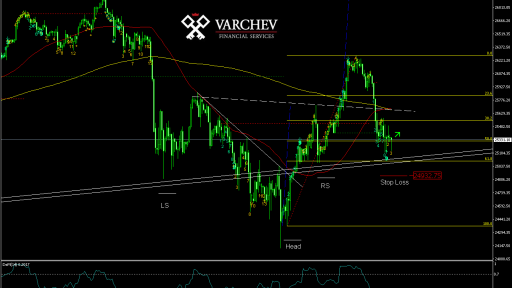

Dow Jones - Good levels for Long positioning

Dow Jones - H4

Our expectations - Long-term upward trend and price after adjustment to support zone. Formed and activated Head & Shoulders formation with appropriate retest and positioning capability with a good odds ratio of yield - 4.5!

Comment: Price in long-term upward trend and after correction to main diagonal. The price forms a reversed Head And Shoulders formation, which is now activated and re-tested. The price goes back into the figure and tests the right shoulder of the figure, with Price Action over the past 24 hours showing that the level is significant for investors who are willing to buy from these levels. There is a bullish pin bar in combination with tweezers formation - positive for the price. 50 crosses 200SMA from bottom to bottom, the price remains below the creeping average. The price holds more than 50% Fibonacci correction of the new upward trend, as we do not have a closed bar - positive for the price and proof that the level is significant for the bulls. DeMarker Sequential counts 9 from the bottom, signaling the end of the downward impulse. DeMarker 14 is in an over-sales area but does not report.

SL: 24 932.75

Alternative Scenario: Passing the price below the main support zone will break the positive scenario and deepen the sell-off.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.