- Home

- >

- Stocks Daily Forecasts

- >

- Dow’s 4,400-point rally in a year and a half has Wall Street debating the stock market’s next move

Dow’s 4,400-point rally in a year and a half has Wall Street debating the stock market’s next move

Against that backdrop, Clemens might say it’s no surprise the Nasdaq Composite Index, booked its 21st record close of 21st on Thursday. The tech-heavy gauge has registered 29 all-time losing highs since November, according to Dow Jones data. (On Friday, the gauge ended in negative territory)

Moreover, the Nasdaq booked its biggest quarterly advance—more than 530 points for about a 10% gain—since the fourth quarter of 2013. And since the Nov. 8 election fueled hopes for a package of market-friendly policies, the index has advanced nearly 14%.

The broad-market S&P 500 index SPX, also registered its best quarter since the last three months of 2013, with a 5.5% rise. The Dow Jones Industrial Average DJIA, is on track for its longest streak of winning quarters. In fact, the Dow has climbed nearly 4,400 points, or about 30%, over the past six quarters, marking its best six-quarter advance since 2006.

Despite those moves, or perhaps because of them, some investors seem more hazy than usual about the direction the market takes from here, especially since by at least one measure stocks are trading at their most expensive levels since 2004.

“Given the fact that valuations are at the very high end of normal and on the edge of expensive, there’s still room for people to change their mind about the market,” John Manley, chief equity strategist at Wells Fargo Advantage Funds, told MarketWatch.

Putting in a top?

So, is a correction—decline from the peak of at least 10%—on the horizon? Or are investors bound to see more gains?

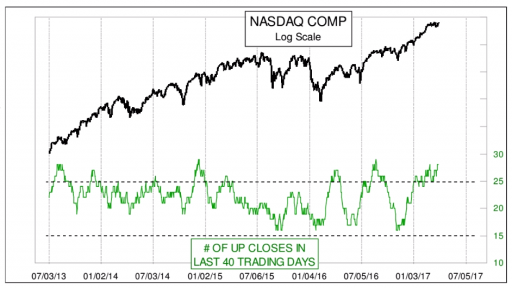

In a Thursday note, prominent technical analyst Tom McClellan suggested that the Nasdaq’s recent run of mostly positive closes, 28 of the past 40 trading sessions, indicates that the market is putting in a top and may be setting the stage for a downturn.The above graphic shows the number of positive closes out of a 40-session cycle, with the top Nasdaq moves represented by the black line indicating daily trading for the benchmark. The correlation has been far from perfect, specifically during 2013-14, but McClellan argued that the Federal Reserve’s resumption of a path of monetary normalization after a decade of easy-money policies will lead to a return of the normal pattern of protracted gains and sharp downturns for the Nasdaq

What really has market participants on edge, however, is the unnatural degree to which the equity gauges have avoided major stumbles over the past five months. The S&P 500 and the Dow each saw only a single 1% daily decline, which occurred on March 21.

In fact, stocks weren’t prone to big moves in either direction. On average, the S&P 500 and the Dow are on track to average an 0.3% daily gain during the first quarter, the smallest average daily move since the mid- to late-1960s, according to Dow Jones data.

And Wall Street’s so-called fear gauge, the CBOE Volatility Index VIX, which briefly touched a recent intraday peakof 15.11 on Monday, is on pace to post its second-lowest quarterly average ever at 11.68, which is well under its historic average of 20. The VIX reflects the balance between supply and demand for insurance against big moves in the S&P 500 over the next 30 days.

Handicapping the downturn

A market correction is inevitable, but when it will occur is anyone’s guess.

Salil Mehta, a statistician and former leader a former director of analytics for the Treasury Department’s $700 billion TARP program, said there is a 13% chance of a short-term bear market, or fall of at least 20% from a recent peak. He sees a more than one-in-three chance of a downturn of at least 10% or better, and a nearly three-out-of-four likelihood of a 5% drop

A 5% drop would effectively wipe out year-to-date gains for the Dow and S&P 500 and chop the Nasdaq’s rise in 2017 in half. But such a move isn’t out of the ordinary, and some even view retreats of that order as cathartic.

So far, however, the market has proved to be resilient, albeit relatively rangebound, even as Trump rattled nerves with his failure to get a vote on a bill to replace and repeal Obamacare. The apparent dysfunction has fueled skepticism about Trump’s ability to win approval of corporate tax cuts, which had been the backbone of the market’s ebullience.

The struggle for direction

“I would say post the ACA-replacement failure, the market is really likely to be a bit directionless,” David Lafferty, chief market strategist at Natixis Global Asset Management, told MarketWatch.

Lafferty said the market may be stuck in a rut with an improving global economy and earnings creating a floor for stocks and lofty valuations capping further sharp gains.

“The movement that you’ve seen in the middle has been based on the optimism around Trump,” Lafferty said.

“If [Trump] is going to struggle and the market’s already gone up 12%, the more [Trump-inspired] expectations are called into question, and the market for bonds are going to get a bid,” driving down yields, he said.

Vassilis Dagioglu, a portfolio manager at Mellon Capital, which manages $360 billion, said fundamentals, including U.S. first-quarter earnings season, which will kick off mid-April, are expected to continue a recent trend of improvement. Analysts have made fewer cuts to earnings estimates than in previous quarters.

In light of that, Dagioglu said he is upbeat on U.S. equities, though he sees markets outside the U.S. as offering better value.

“We will see some pullbacks, 5% is likely, but barring some kind of external shock, the odds of a 15% or 20% drop are actually quite low at this point,” he speculated.

Wells Fargo’s Manley said that a lot of folks are thinking about, and even bracing for, a correction. Sometimes, that serves as an antidote against a pullback: “Everyone’s on tenterhooks, and that’s good. Nerves are a wonderful thing, the more we worry about things, the less likely they are to happen.”

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.