- Home

- >

- Daily Accents

- >

- Draghi’s Caution on Inflation Signals, ECB Stimulus Stays for Now

Draghi's Caution on Inflation Signals, ECB Stimulus Stays for Now

Mario Draghi has left little doubt that he’s not ready to accept euro-area inflation has truly returned, and a closer look at data from the 19-nation region helps explain his hesitation.

The European Central Bank president will probably reiterate his assessment on Thursday that underlying price growth remains subdued even after inflation accelerated to 2 percent -- nominally above the institution’s goal. A hefty upgrade of near-term projections as flagged by Bundesbank President Jens Weidmann is unlikely to change that message.

At the heart of the debate is the question whether the latest pickup meets Draghi’s criteria of being broad-based, durable, self-sustained and stable over the medium term. In general, the answer is no.

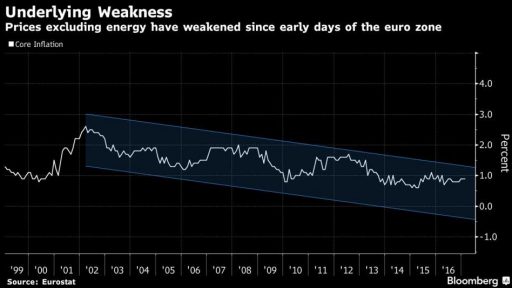

Policy makers have zoomed in on core inflation -- the measure that excludes volatile components such as food and energy -- to justify record-low interest rates and a 2.28 trillion euro ($2.4 trillion) asset-purchase program that is currently set to run until at least December. The rate remains stuck below 1 percent, but what’s worse is that the trend has consistently pointed down in the euro’s 18-year history, suggesting structural weaknesses may be at play.

Years of crises and below-potential growth have left resources idle and unemployment close to 10 percent. Goods and services inflation, components contributing to the core rate, show few signs of picking up.

Inflation expectations are receding. After policy makers’ preferred gauge of future price developments approached levels of below but close to 2 percent at the end of last year -- signaling the ECB’s goal was in sight -- it’s now on the wane once more.

Some three-quarters of euro-area countries have seen rates accelerating above 1.5 percent in January, the last month for which final data are available.

But annual price gains, driven mostly by the impact of a slump in oil in 2015 and a surge last year, will fizzle out toward the end of this year. Divergence between individual euro-area countries. Inflation stood at 0.2 percent in Ireland and 3.1 percent in Belgium in January, is also proving challenging, according to former Bank of England Governor Mervyn King.

“The European Central Bank undoubtedly has the most difficult job,” he told Bloomberg Television in an interview on Tuesday. “It’s struggling to impose the same monetary policy on a group of countries that self-evidently need quite different monetary policies.”

Bloomberg

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.