- Home

- >

- Trading University

- >

- Easy trend following trading strategy for index and currency trading

Easy trend following trading strategy for index and currency trading

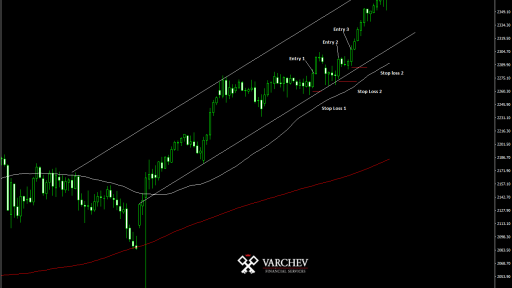

Extremely easy to use, trend strategy suitable for beginners and people who can not devote time to in-depth market analysis.

Time Frame: D1

Tools: The strategy is good for trading futures SP500 and Dow Jones, works on all currency pairs but it is better to target more the trend currencies such as the JPY.

How does strategy

The indices: two minutes before the end of the current trading day place a pending order 10 pips above the peak reached during trading with a stop above or below the top of the bar, depending on whether you want to enter a long or short position in the market.

In currency pairs: 23:30 to place a pending order 10 pips above or below the top of the current bar with a stop above or below the levels of the current bar depending on whether you want to enter a long or short position in the market.

Look for clear signal bars that feature better than others!

Target and the indices and currencies are the same and are measured in percentages.

1. First we aim to shift the stop on the opening price - what happens when the price goes in our direction and go 20% of the body of the signal bar. For example, if the signal bar e 100 pips, then wait for the price to move 20 pips in our direction and displacement stop to zero.

2. Second thing to do if the price continued in our direction and reaches a difference of 50% is to move the stop on + 20 pips profit.

3.Third target is when the price reaches 100 pips from the entrance. Then we should stop stuck to + 70 pips. If prices continue to evolve in our direction, then every 20% increase should not overshadow stop by + 20%.

Here is a current example with futures on the index SP500:

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.