- Home

- >

- Daily Accents

- >

- ECB considering to reduce Quantitative Easing by half

ECB considering to reduce Quantitative Easing by half

ECB representatives are considering halting the monthly bond purchase by at least half since early January and keeping this amount for at least nine months. Reducing the 30 billion-dollar ($36) quintuple from the current 60 billion-euro rate is a viable solution, officials who asked not to be identified because the talks are private.

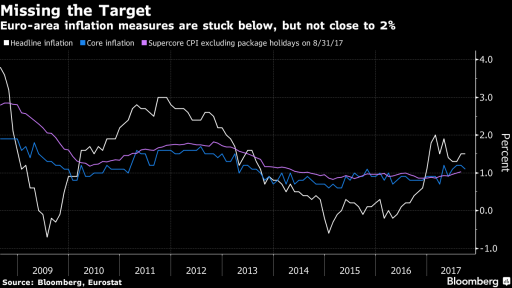

The members of the ECB, led by Mario Draghi, are becoming more confident that they can agree on October 26th to reduce the size of QE. ECB representatives are considering reducing purchases from January to September 2018, if necessary after September 2018. program to be terminated, prolonged or prolonged with increased volume of purchases. Overall, sentiment in the ECB will be dictated by economic data provided by the euro area. Focus remains inflation in the region.

EUR/USD traded with a slight increase of 0.14% mainly due to worse US data on retail sales and inflation. We expect investors to focus their attention on euro area data in the coming months, and benefit from longer positions.

Despite Hawkish's moods among ECB members, Mario Draghi said he is considering keeping interest rates at lower levels by not committing to a specific percentage.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Bloomberg: ECB to Consider Cutting QE Purchases in the Next Year

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.