- Home

- >

- Fundamental Analysis

- >

- ECB Won’t Get Far Above Zero With Rate Hikes, Pimco Says

ECB Won't Get Far Above Zero With Rate Hikes, Pimco Says

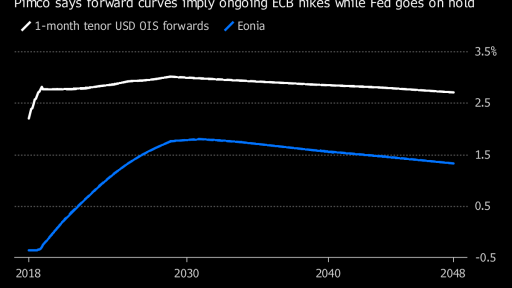

The European Central Bank won’t make much progress raising interest rates because it’ll tighten just as the U.S. economy slows, predicts Pacific Investment Management Co.’s Andrew Bosomworth.“I don’t think Europe will get very far above zero,” Bosomworth, a managing director at Pimco, said in an interview in Frankfurt this week. “There’ll be a very short window in which the U.S. Federal Reserve is on hold, and Europe can keep on growing and the ECB can keep on normalizing, before the slowdown kicks in over here through the trade channel.”

Investors expect the ECB to raise borrowing costs from record lows late next year, and Bosomworth predicts the first step will be to lift the deposit rate by 15 basis points from the current minus 0.4 percent. He says it’ll then move all official rates together, pushing the main reference rate to a quarter percent from the current zero.

The U.S. economy is in its second-longest expansion on record, raising speculation over when the run will end. Growth is expected to moderate in 2019 as the effects of President Donald Trump’s tax cuts wane, and his trade tariffs and a strong dollar weigh on the economy. As if to prove his point, GDP reports on Tuesday showed the euro-zone economy growing at its weakest pace in four years. Italy’s output stagnated and the Bundesbank has said German growth probably stalled last quarter.

Ultimately, as the euro-zone population ages, there are parallels with another developed economy that has struggled for years to escape the zero lower bound.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.