- Home

- >

- Fundamental Analysis

- >

- Economists question the success of the new ECB program

Economists question the success of the new ECB program

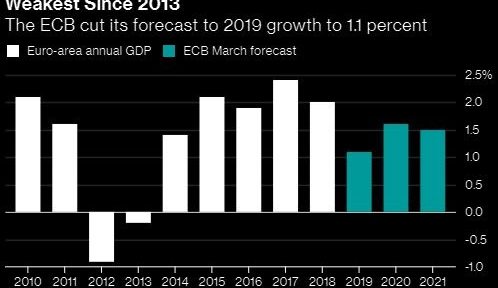

According to some experts at the European Central Bank, the Bank's low economic growth forecast in 2019 still sounds optimistic.

There seems to be some doubt in the internal structures of the bank that the current forecasts will not materialize in the first half of the year. Mario Draghi, the president of the bank, today stressed that growth risks continue to exacerbate development trends, which affect the change in the bank's position.

Draghi himself emphasized the improved incentive package that should support the economy. The package was unanimously approved by the Board of Governors.

The current pruning of the ECB's growth forecasts is the strongest since the bank inhibited quantitative easing four years ago, predicting an economic expansion of 1.1%. The bank has unveiled a new wave of fiscal stimulus, including more loans to banks and maintenance of interest over a longer period of time.

The measures announced today include a bank lending program for two years to strengthen the credit flow in the economy. The magnitude of the incentives surpassed the expectations of economists and analysts.

ECB economists tend to raise the original interest rate above their benchmark, which will allow the premium to be reduced if banks can achieve their credit goals. The Task Force has the task of forming further details on the new program, but without too much hurry before the next ECB meeting in April.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.