- Home

- >

- Daily Accents

- >

- Economy Threatens U.S. Stocks More Than Trump

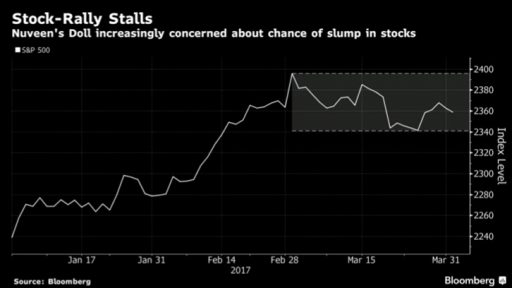

Economy Threatens U.S. Stocks More Than Trump

Money manager Bob Doll is becoming increasingly worried that the American economy poses a greater threat to the U.S. stock rally than the political tensions traders are currently focused on from President Donald Trump and Congress.

Sentiment on the U.S. economy may be too high, leaving investors vulnerable to negative surprises on growth, according to Doll. Equities and high-yield bonds may suffer in the short-term, with the chance of a deeper sell-off growing, he said. He remains bullish on equities longer-term.

“We remain constructive in the medium-and long-term toward risk assets, but are growing increasingly cautious about the short-term outlook.”

“More than politics, the economy probably presents a more probable roadblock for equities.”

Thomas J. Lee, managing partner at Fundstrat Global Advisors LLC, also expects a pullback in the S&P 500 Index.

Strong signals on U.S. growth have helped drive a surge in stocks that’s added more than $3 trillion to the value of American equities in the past year.

However, worse-than-forecast monthly auto sales on Monday offered a warning that Americans may have become more thrifty.

On politics, Doll pointed to a lack of progress on a budget agreement and some roadblocks on tax reform. Key to Doll’s thesis for short-term declines in stocks is an overoptimistic stance among investors on the economy. Still, he acknowledges it’s not clear what may provide the impulse for this dent to economic data.

“We are not expecting a significant economic slowdown, but the nearly non-stop pace of positive economic data is unlikely to continue,” he said. “At some point, a setback will likely be triggered."

Source Bloomberg

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.