- Home

- >

- Opportunities for profit today

- >

- EM-Bulls take advantage! Here are the most promising sectors

EM-Bulls take advantage! Here are the most promising sectors

As for emerging markets, the bulls are finally beginning to take advantage. After the fall of nearly 25% on stock markets in emerging markets, assets began to show some stability stemming mainly from the declining influence of the trade war and the strong motivation of the central banks of Turkey and Argentina to protect their currencies.

At present, Latin America, Eastern Europe, the Middle East, and Africa have the best prospects for currency and bond investments. Asia remains the most promising in the stock market.

Here are the main expectations for Q4 of 2018.

By Region:

On the chart below you can also track the main driving forces of emerging markets:

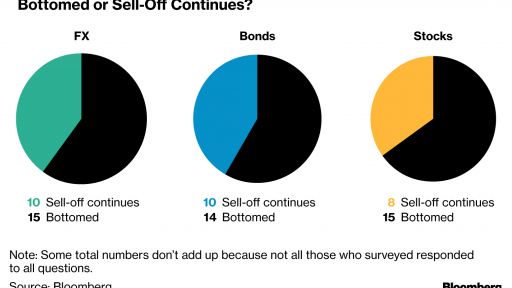

Q4 looks like Mexico will be the most attractive country in emerging markets. On the next chart, we can track what expectations are in relation to FX, Bonds and Stocks:

Below are the inflation expectations and prospects for economic and monetary policy for 11 emerging economies.

Inflation expectations:

Economic Perspectives:

Monetary policy:

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.