- Home

- >

- Daily Accents

- >

- Emerging markets are growing while the rally in Europe and US is slowing

Emerging markets are growing while the rally in Europe and US is slowing

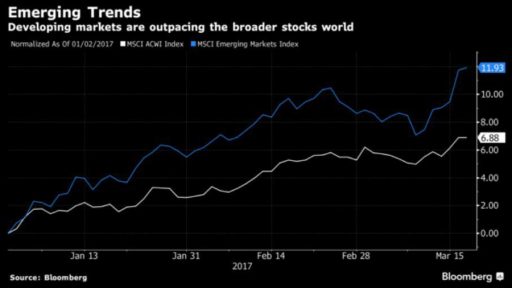

Emerging markets headed toward the best week in eight months even as the global equities rally spurred by the Federal Reserve’s outlook lost momentum. The dollar was poised for its biggest weekly loss since February.

Developing nation shares rose a sixth day, while both European stocks and futures for the S&P 500 Index were little changed. Bonds sold off in Europe after a policy maker said the ECB may tighten the deposit rate before other borrowing costs.

Oil prices were poised for their first weekly gain this month after Saudi Arabia’s Energy Minister told Bloomberg News the kingdom may prolong production cuts. A gauge of Group-of-10 nation carry returns headed for the best weekly advance since January as the greenback slid.

Global stocks are on course for the best week since January after the Fed raised its benchmark lending rate a quarter point without accelerating the timetable for future hikes. U.S. policy makers’ reticence to speed up tightening is prompting investors to ditch the dollar in favor of higher-yielding currencies, while the most tranquil markets in two years are spurring a hunt for returns in riskier landscapes.

“A less hawkish monetary policy in the U.S. is more likely to push assets outside of the U.S. into higher-risk, higher- return markets,” James Woods, a Sydney-based investment analyst at Rivkin Securities, said in a phone interview. “A weaker dollar is supportive of those emerging markets generally. I’m not sure whether its going to be long-lived though. People are going to get back to focusing on the next Fed hike, and also Trump’s policies which would be dollar supportive.”

Volatility is extending its retreat after a series of central bank policy decisions passed without incident and the Dutch election results eased concern about the rise of European populism. JPMorgan Chase & Co.’s G7 Volatility Index fell 7.5 percent Thursday to the lowest since November 2014. One-month implied volatility for the Euro Stoxx 50 Index has dropped this week and trades near its lowest level since July of the same year.

What investors will be watching:

- The focus Friday will be a meeting between Donald Trump and Angela Merkel, while Steve Mnuchin attends his first G-20 finance chiefs gathering in Germany as U.S. Treasury secretary.

- Rex Tillerson continues his first trip through Asia as U.S.

Secretary of State, stopping in South Korea before heading to Beijing. - Economic data on Friday include U.S. industrial production for February, while Tiffany & Co. is among companies scheduled to release earnings.

Here are the main moves in markets:

Stocks:

- The Stoxx Europe 600 Index was little changed as of 10:44 a.m.

in London. - The MSCI Emerging Markets Index rose 0.3 percent, bringing its rally for the week to 4.3 percent, outpacing a 1.4 percent advance for the MSCI All-Country World Index.

Currencies

- The dollar slipped 0.1 percent. It weakened against all its major peers except the Canadian dollar.

- The euro was little changed at $1.0768, on course for its best week since the period ending Jan. 13.

Commodities

- West Texas Intermediate gained 0.4 percent to $48.93 a barrel and Brent traded up 0.3 percent to $51.89.

- Gold was poised for its first weekly advance this month. Bullion for immediate delivery added 0.2 percent to $1,228.93 an ounce, on track for a weekly gain of 2 percent.

Bonds

- Benchmark yields from Germany to Italy rose. The yields on bunds due in a decade advanced two basis points to 0.46 percent. That of Italian peers added three basis points to 2.4 percent.

- French yields climbed three basis points to 1.11 percent.

Source: Bloomberg

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.