- Home

- >

- Fundamental Analysis

- >

- Emerging markets remain the most attractive for Wall Street

Emerging markets remain the most attractive for Wall Street

Shares of emerging market companies managed to outperform their partners from the developed countries in Q1, despite Sell Off-a on the markets. The decline was caused by several factors, but the important thing at the moment is that a big picture remains positive, and the current retracement gives a rare opportunity for long positioning on the indices.

After it became clear that EM (Emerging Markets) returns traditionally above emerging economies from Europe and the US, we should focus on them.

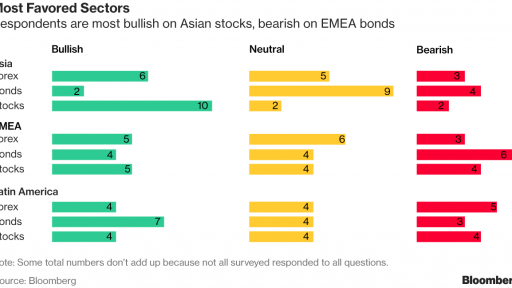

In brief - The best option is the Asian shares, followed by the Latin American bonds, according to a survey of 15 participants, including BNP Paribas Asset Management, Deutsche Bank Wealth Management, Mizuho Bank Ltd., the largest investment banks and funds in the world. , UBS Group AG and others.

Here are the general sentiment among them:

Such surveys are very rare, and therefore respondents are asked a number of questions on a variety of topics related to capital markets.

What impact will the FED have on the FOREX market?

How will Trump's import tariffs affect the value of world currencies?

Will China continue to devalue Yuan and how will this affect local currencies?

Meanwhile it seems. that oil has the potential to lead to major headaches in some countries. Which are the oil-dependent currencies?

Where will the biggest impact, the decline in the technology sector?

For the FED we understood, what happen with the ECB and Bank Of Japan?

Where are the geopolitical risks and where can we expect shocks?

Which are the countries or currencies at greatest risk of an internal political turmoil?

Source: Bloomberg Pro Terminal

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.