- Home

- >

- Daily Accents

- >

- Equities Fall Before Jobs: Markets Wrap

Equities Fall Before Jobs: Markets Wrap

Oil slid to its lowest since November and Chinese equities headed for their longest losing streak this year amid weakness across most stock markets.

The slide in oil saw an intraday jump in the yen, a haven in times of volatility, while the greenback edged higher and gold rallied from a seven-week low. The Shanghai Composite Index was in line for a fourth weekly decline as regulators try to curb leverage and speculation. The Aussie dollar, the worst- performing G-10 currency this quarter after the Canadian dollar, headed for a third straight weekly loss. Japan and South Korea are closed for a holiday.

Barclays Plc analysts were among those to caution earlier that this week’s drop in commodities may have more to do with particular supply and demand dynamics in individual resource markets than concerns about a probable peaking in Chinese economic growth or last quarter’s soft patch in the U.S.

Australian and New Zealand government bond yields gave up some earlier gains as those of 10-year U.S.

Here are the main moves in markets:

Stocks

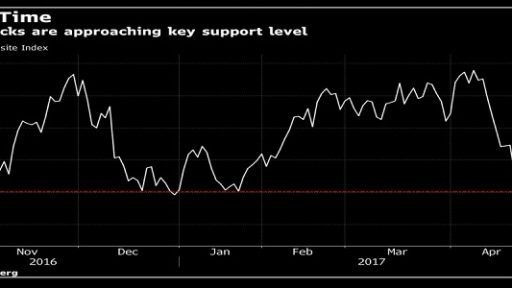

* Futures on the S&P 500 Index dropped 0.3

*Euro Stoxx 50 futures were down 0.4 percent.

* The Shanghai Composite Index was down 0.9 percent at 2:33 p.m.local time, below 3,100 and headed for its lowest close this year.

* In Hong Kong, the Hang Seng China Enterprises Index tumbled1.8 percent and the Hang Seng Index dropped 1 percent.

* Australia’s S&P/ASX 200 Index lost 0.7 percent, falling for a fourth straight day.

Currencies

* The yen rose 0.3 percent to 112.13 per dollar, while the Bloomberg Dollar Spot Index kept gains within 0.1 percent.

* The Australian dollar fell 0.3 percent to 73.83 U.S. cents, in line for a weekly loss of 1.4 percent.

Commodities

Gold rose 0.4 percent to $1,233 an ounce.

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.