- Home

- >

- Stocks Daily Forecasts

- >

- Equity analysts are sounding alarms on financial shares

Equity analysts are sounding alarms on financial shares

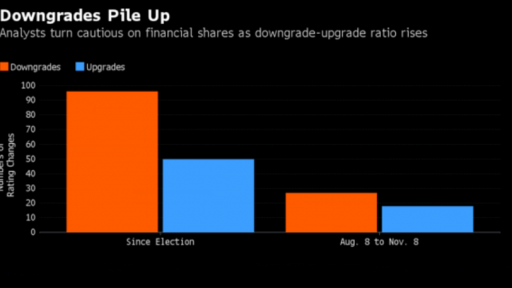

Among stocks from JPMorgan Chase & Co. to Citigroup Inc., downgrades have outnumbered upgrades by a margin of almost 2-to-1 since the election, according to analyst recommendations compiled by Bloomberg data. That’s a deterioration from the previous three months, when the downgrade-upgrade ratio sat at 1.5.

Analyst sentiment is souring as the KBW Bank Index has surged 29 percent since the election, lifting valuations to the highest since the aftermath of the global financial crisis. While lenders are well positioned to benefit from higher interest rates and President Donald Trump’s policies, the pace of gains may have gone too far too fast, analysts said.

The advance in share prices has pushed banks’ implied cost of equity, or expected long-term return, to below 10 percent, a level that’s usually associated with negative share returns over the next six months, Citigroup’s Keith Horowitz. wrote in a Feb. 16 note.

The caution goes against a phalanx of investors who are betting the bank rally will last. Since Trump’s election, almost $10 billion of fresh money has flown to exchange-traded funds that buy financial shares.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.