- Home

- >

- Stocks Daily Forecasts

- >

- ETF issuers rush to capitalize on Trump

ETF issuers rush to capitalize on Trump

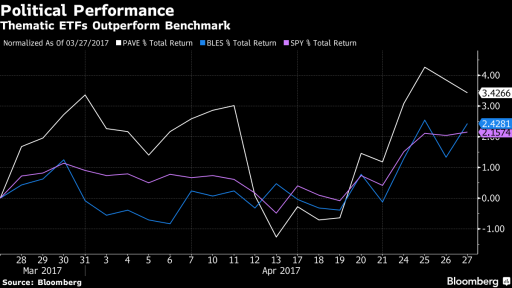

The first hundred days of Donald Trump’s presidency have seen a slew of new exchange-traded funds that seek to capitalize on the administration’s policies and platforms. A few have proven to be decent bets.

Thematic ETFs have proliferated as asset managers seek new avenues for growth. Filings show funds started in the last six months looking to trade on political agendas, such as tax reform and infrastructure spending. Such strategies are a matter of survival for smaller issuers, with the likes of Vanguard and BlackRock already dominating "plain-vanilla" categories, according to Bloomberg Intelligence’s Eric Balchunas.

Their success is modest but improving. In March, Global X Management Co. launched the U.S. Infrastructure Development ETF to track companies with exposure to public works. Under ticker PAVE, it’s garnered about $6.6 million in assets and trades about 19,000 shares a day -- not insignificant, though a fraction of mainstream ETFs.

Global X’s fund, whose top holdings include rail stocks such as CSX Corp. and Union Pacific Corp. along with industrial names like Fortive Corp., Eaton Corp., and Rockwell Automation Inc., returned 3.4 percent over the past month through April 27, compared to the S&P 500-tracker SPDR’s 2.1 percent.

"In the last administration, there was nothing like this," Balchunas said. And "when Bush was elected, people were still trying to cover the plain vanilla" funds.

This month, Active Weighting Funds ETF Trust registered three U.S.-policy focused ETFs, which are awaiting approval. They focus on stocks likely to be impacted by government action reflecting Republican policies, Democratic policies and progress in Trump’s tax agenda.

Source: Bloomberg

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.