- Home

- >

- Uncategorized @en

- >

- EUR has the potential to reach 1,30$ until the end of 2017

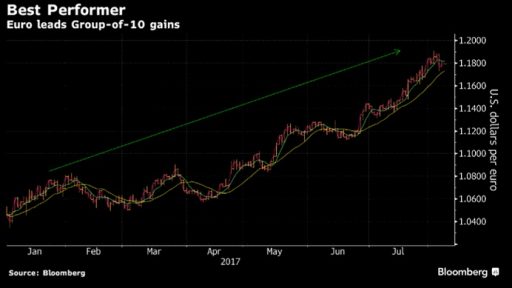

EUR has the potential to reach 1,30$ until the end of 2017

“To be short euros here is absolutely lethal,” said Ulf Lindahl, chief executive officer of A.G. Bisset Associates, who manages about $1 billion from Norwalk, Connecticut. He expects the currency to rise to $1.30 by the end of the year, if not sooner. Even after its 3.6 percent rally in July, investors and analysts are predicting further gains.

So who’s buying euros:

1. Hedge Funds:Hedge funds initially missed out on the euro rally by holding net-bearish bets until May before jumping in, according to data from the U.S. Commodity Futures Trading Commission. Since then, speculators have piled headlong into bullish bets, building up the biggest net-long position in six years.

2. U.S. investors will “increasingly look overseas for returns,” spurring flows into euro-denominated investments, said Lee Ferridge, head of macro strategy for North America at State Street Global Markets in Boston. They’ll probably do so without hedging against a weaker dollar, which would boost profits earned abroad, he said.

3. European Investors: Rising confidence in the European economy recovery gives investors there a good reason to buy assets closer to home, bolstering the euro, State Street’s Ferridge said. The euro has shaken off its status as a second fiddle as European growth and inflation recovered, while political risks subsided after the election of French President Emmanuel Macron, spurring bets that the European Central Bank will pare stimulus.

4. Central banks: Reserve managers could be another key buyer of euros in the months ahead, according to Kwok and State Street’s Ferridge.

Central banks have boosted the euro’s share of their holdings in recent quarters after reducing holdings in 2014 and 2015 when concerns about Greek debt and political turmoil diminished its appeal as a reserve currency. While the outlook for Europe has stabilized, U.S. political drama has escalated. Against this backdrop, reserve managers may opt to rebuild their euro holdings, which would cause yet more strength for the currency.

Source: Bloomberg Pro Terminal

Trader Nikolay Georgiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.