- Home

- >

- FX Daily Forecasts

- >

- EUR/JPY – Technically and fundamentally, the growth seems more likely

EUR/JPY - Technically and fundamentally, the growth seems more likely

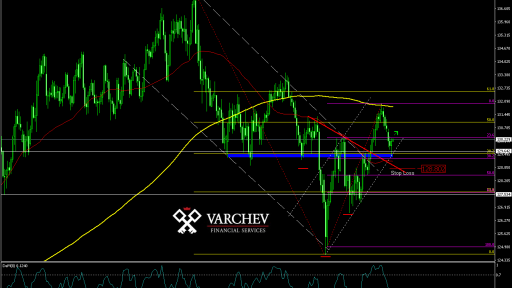

EUR/JPY - D1

Our expectations - The traders began to accumulate the good tone of the meeting between Jean-Claude Juncker and Donald Trump as positive for both the indexes and the euro. If we look at the ECB, good trade relations between the US and the EU are welcome and in line with the central bank's plans to tighten monetary policy. Following the good news from the United States, I expect the ECB tomorrow to confirm its intentions to tighten monetary policy and bring the euro up. On the other hand, the JPY continues to decline against the backdrop of the rising stock market. Growth was born during the US session, as investors in Asia and Europe have not yet mastered it. This means that during the Asian and European session tomorrow a large number of investors will opt to unload their hedging positions at the yen.

Technical, pair is located in a short ascending channel, at key levels of support. After the price activates the reversed Head And Shoulders, he has a 50% Fibonacci correction of the main trend, which in itself says the downward medium-term movement is over. The current support area is formed by horizontal support, 50SMA, the major diagonal of the new upward trend, and 38.2% Fibonacci correction coinciding with the old trend. Price Action - Pin level of support - positive for the price. DeMarker is in an over-sales area but has not yet signaled a reversal.

SL: 128,802

Alternative Scenario: If the price goes below the support zone and stays there, the positive scenario will be spoiled and more likely to see a decrease in the pair's price.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.