- Home

- >

- FX Daily Forecasts

- >

- EUR/USD: Sellers in short term control, markets awaiting ECB this week

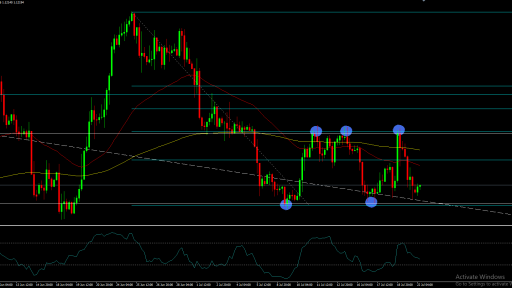

EUR/USD: Sellers in short term control, markets awaiting ECB this week

For the most part of the past two weeks, the most traded currency pair jumped around 1.1200 1.1280, with the price now pointing to 1.1210-20 for the beginning of the new week. Sellers remain in short-term control as price action-a is kept below the two key periodic and also under 100 MA @ 1.1248.

As we navigate through the price movement this week, keep in mind that everything is related to the expectations of the ECB meeting on July 25th.

To a greater extent, the markets expect the central bank to change its expectations for future policy and to provide new stimuli in September, but there is also a small chance to act next week.

On Wednesday, we will have key euro area data as we will receive the preliminary PMI report in France, Germany and the whole bloc. I expect this to be included in the expectations about how fast ECB will take things in its own hands (this week or September).

And on the EUR / USD, focusing on the central bank, the common currency is expected to remain the weaker currency of both, as traders begin to estimate the chances of just 25 basis points down from the Fed.

There are no Fed spokespersons this week in anticipation of the FOMC meeting, so I expect the markets to stay calm over the next two days trading in the range noted above. In my opinion, the EUR / USD price action is between 1.1200-50 for most of the wait of the ECB meeting.

As for then, we will take a position only after a confirmed break on one side of the chop.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.