- Home

- >

- FX Daily Forecasts

- >

- EUR/CHF: 1188 days after the crash caused by the SNB, what’s next?

EUR/CHF: 1188 days after the crash caused by the SNB, what's next?

After just 1188 days, the EUR / CHF managed to recover from the collapse caused by the Swiss National Bank on January 15, 2015.

What happened then?

The Swiss rose almost 30% against the euro after the Swiss National Bank surprisingly abolished the fixed maximum rate against the combined currency, which was around 1.2100 euros per franc. In the first minutes EUR / CHF reached 0.8052, and then settled around 1.0300. USD / CHF collapsed by about 25%, reaching a price of 0.8900 at the time of the crash.

What's the story, what's next and will it be 1.2000 key for the couple?

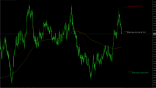

For a short while, we will probably see trouble for the bulls, but the main trend remains rising for over a year. Taking into account the strong momentum we are seeing over the past two weeks, the price options are two - strong breakthrough, or narrow consolidation between 1.1840 and 1.2000 rectangle of the graph). Indicators are also used in short positions. Sequential counts 12 on top of a possible 13 - probable end of the upward pulse. DeMarker is in the over-purchase area and record levels not reached throughout the history of the currency pair (since 1999 when the EUR came into circulation).

1.2000 is historic for traders who have witnessed the collapse, and the market certainly remembers SNB's decision. Traders will probably stick to the level because it's an important psychological limit, but I expect it to lose weight over time.

The trend remains long, and any correction will be a good reason to target Buy button.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.