- Home

- >

- Fundamental Analysis

- >

- Euro slips with stocks after Macron’s expected win

Euro slips with stocks after Macron’s expected win

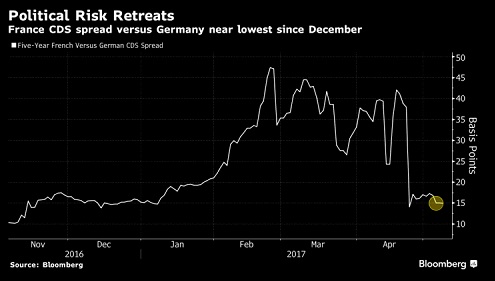

Europe’s common currency weakened and equities dropped following a convincing defeat of populism in France’s presidential election that was already priced in by investors. Crude fluctuated as Saudi Arabia and Russia signaled output cuts will be extended.

The euro fell after climbing for five of the past six days in the buildup to the election of Emmanuel Macron as France’s next president. Commodities producers sapped any positive momentum in the Stoxx Europe 600 Index after recent raw materials declines. The dollar strengthened, Treasuries held steady and futures for U.S. stocks pointed lower. Oil swung as the Saudi oil minister said OPEC’s supply cuts will be extended into the second half of the year and possibly beyond.

Macron’s decisive triumph over the anti-euro Marine Le Pen will strengthen the EU and deal a blow to the populist wave that has roiled western democracies for the past year. But the scope for a relief rally was limited after market gains in the buildup to Sunday’s vote. Global stocks are trading at the highest ever, and U.S. equities also closed at a record last week after better-than-forecast data on American jobs.

Japan’s Topix soared 2.3 percent to the highest since December 2015 as investors played catch-up after a three-day holiday.

A selloff in China continued, with the Shanghai Composite Index dropping 0.8 percent to the lowest level since October, despite data showing overseas shipments held up in April.

The Stoxx Europe 600 slipped 0.2 percent at 10:36 a.m. in London, dragged down by miners.

Futures on the S&P 500 were down 0.2 percent. The benchmark gauge climbed 0.6 percent last week, closing Friday at an all- time high.

The euro fell 0.5 percent to $1.0945, after gaining as much as 0.2 percent earlier. The currency has been trading near the highest level since November.

The Bloomberg Dollar Spot Index advanced 0.2 percent following four straight weeks of declines. West Texas Intermediate fluctuated before retreating 0.3 percent to $46.09 a barrel.

Gold climbed 0.2 percent to $1,230.20 an ounce. The metal fell 3.2 percent last week.

Source: Bloomberg

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.