- Home

- >

- Daily Accents

- >

- Europe hopes for a better 2019 for the banking sector

Europe hopes for a better 2019 for the banking sector

If, in general, bank stocks are bad this year, it's better not to replace European banks.

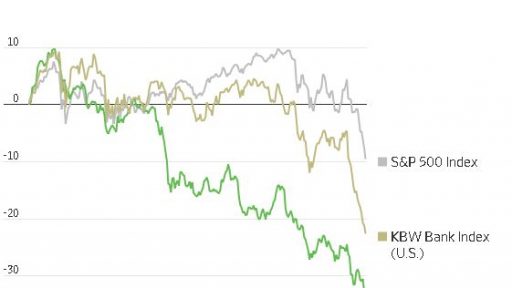

The Euro STOXX bank index is down 34% this year. For comparison, the US banking sector's decline in the KBW index is 23%. The cost of insuring against European bank debt in the event of bankruptcy has doubled compared to 2017 levels.

Worse, it is not expected that a positive catalyst will appear on the horizon to trigger a reversal of direction. The low interest rates, the economic and political uncertainties that are currently depressing stock prices down, are expected to continue to exert a negative effect on markets in 2019. If the global economic situation gets worse, European banks will be exposed to greater risks compared to other banks around the world. This risk comes from the fact that banks continue to report low profits.

A potential ray of hope for European banks comes from the prospects for completing the current monetary policy of holding low interest rates. This will free the way for a move to their rise. Years of low or even negative interest rates pulled the banks back and their net interest margin lagged behind. The problem is that the ECB will start raising interest rates only in the summer of 2019. Stopping QE has not been enough positive news for the banking sector in Europe.

Even then, however, high interest rates will need extra time to have an effect on the European economy and the European banks. This will be due to the fact that it will take time until old long-term loans are replaced by new ones with higher interest rates. An effect already in the US and Canada. Surely, however, this will not happen in 2019 or 2020.

Other factors that burden European banks are the uncertain political situation. Brexit is the main reason and has the potential for strong economic disruption. On the other hand, the domestic politics of Germany and France and economic reforms are starting to retaliate.

The way European banks have taken over since the financial crisis has proven to be far more severe than in Asia and the US. The path started with less capital available and business models that did not withstand the post-crisis regulation changes. Then came the eurozone crisis, which further delayed the expected restructuring, and the QE of the ECB was launched.

Deutsche Bank AG shares are down 56% in 2018, and UniCredit SpA is down 40%. Italian banks, in particular, have significantly lowered the downward index of the banking sector. The problems with the Italian budget, the increase in bad loans and the weak performance of government securities scared investors.

Source: The Wall Street Journal

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.