- Home

- >

- Daily Accents

- >

- Europe shares rise while metals sell-off continues: markets wrap

Europe shares rise while metals sell-off continues: markets wrap

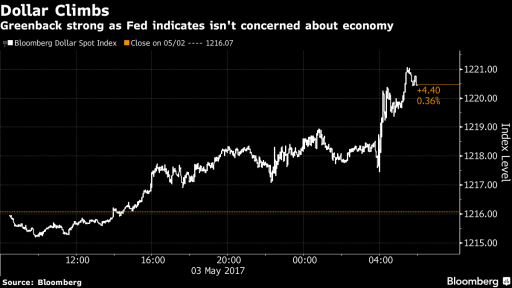

European stocks opened higher as earnings reports underscored that the continent’s economy is on the mend, while shares in Australia and China dropped again. The dollar continued to gain following the Federal Reserve’s policy meeting.

Iron-ore futures fell the most in three months and metals extended their biggest daily decline this year, weighing on the Australian dollar. U.S. Treasuries, which didn’t trade in Asia as Japan was closed for a holiday, continued to fall after the Fed reiterated plans for gradual interest-rate increases. South Korean shares rallied to a record high.

The Euro Stoxx 50 index gained for a third day and the Stoxx Europe 600 and FTSE 100 also headed higher after first-quarter earnings from companies including HSBC Holdings Plc and Royal Dutch Shell Plc beat estimates.

Fed Chair Janet Yellen and at least five other central bank officials are scheduled to speak Friday, presenting a chance to explain the decision to leave interest rates unchanged if they so choose. The U.S. fiscal outlook may also be in play, with the House expected to vote Thursday on a new version of a health-care bill. Majority Leader Kevin McCarthy says the Republican legislation will have the numbers to pass, but given the earlier struggles it’s far from a done deal.

Here are key events and data releases due:

- As Brexit talks begin, the European Union is expected to Thursday publish legislative proposals that would force London’s euro clearing operations to either accept EU oversight or relocate to the continent.

- Voters in France go to the polls Sunday for the second round of presidential elections.

- Companies releasing earnings this week is Time Warner Inc., and Royal Dutch Shell Plc.

Here are the main moves in markets:

Currencies

- The yen was steady at 112.73 per dollar as of 8:15 a.m. in London. The euro was unchanged at $1.0886. - The Bloomberg Dollar Spot Index was up 0.1 percent after gaining 0.4 percent Wednesday.

- The pound was down 0.2 percent at $1.2843.

- The Aussie fell 0.3 percent to 74.04 U.S. cents, after Wednesday slumping 1.5 percent, the most since November.

Bonds

- The yield on 10-year Australian government bonds rose 5 basis points to 2.64 percent.

- Yields on 10-year Treasuries rose 1 basis point to 2.33 percent.

Stocks

- Futures on the S&P 500 Index rose 0.1 percent after the underlying gauge slid 0.1 percent Wednesday. - The Stoxx Europe 600 Index rose 0.2 percent, while the FTSE 100 jumped 0.6 percent.

- Australia’s S&P/ASX 200 Index lost 0.3 percent. The Hang Seng Index also fell 0.3 percent, as did the Shanghai Composite Index.

Commodities

- A measure of iron-ore futures slid 7.3 percent on the Dalian Commodity Exchange.

- Copper futures dropped 0.3 percent after sliding 3.7 percent Wednesday, the worst tumble since 2015.

- Nickel futures fell 1.3 percent following a 3.3 percent drop the previous day. Lead was down 0.8 percent, aluminum was 0.4 percent lower and zinc dropped 0.6 percent. The London Metal Exchange LMEX -

- Metals Index slumped 2.5 percent Wednesday.

- Oil declined 0.8 percent to $47.45 a barrel.

Source: Bloomberg

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.