- Home

- >

- Daily Accents

- >

- European stocks have increased after the Fed raised rates and populist parties in Europe lose positions

European stocks have increased after the Fed raised rates and populist parties in Europe lose positions

European stocks rose after the Federal Reserve raised interest rates without speeding up its timeline of further hikes, while election results in the Netherlands spurred investor relief over the defeat of its populist party.

The Stoxx Europe 600 Index added 0.6 percent at 10:10 a.m. in London, the most in two weeks. Industry groups deemed to benefit most from global growth led the advance, after the Fed noted the robustness of the U.S. economy, while saying it intends to keep its monetary policy accommodative for “some time.” The Dutch AEX Index rallied 0.8 percent, poised for its highest close since December 2007.

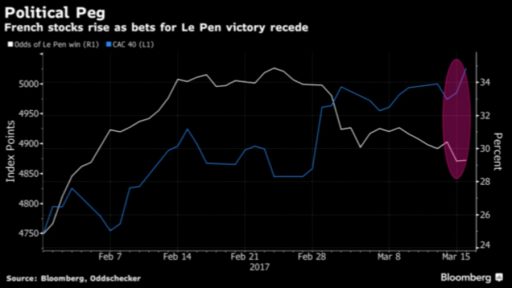

Concern about political uncertainty has preoccupied European stock investors in 2017, with elections also approaching in France. The probability of a victory for the country’s anti-euro candidate Marine Le Pen declined after the anti-Islam Freedom Party of Geert Wilders lost in the Netherlands, according to data based on bookmakers’ quotes on Oddschecker.

“Markets are being allowed to ponder the potential for less populist French and German political outcomes in the months to come, while further U.S. stimulus supports both U.S. growth and Fed policy normalization, in turn helping global growth,” Mike van Dulken and Henry Croft, analysts at Accendo Markets, wrote in a note.

- Metal prices rose following the Fed update, pushing Stoxx 600 miners toward their biggest gain since November. Energy shares tracked oil higher, while banks were also among the best performers.

- The VStoxx Index of euro-area volatility plunged 22 percent, poised for its biggest slump on record. The move was accentuated by the expiration of Euro Stoxx 50 March options tomorrow, according to Louis Capital Management’s Christophe Moser.

- Among shares active on corporate news, Deutsche Lufthansa AG climbed 4.4 percent after the airline said it sees 2017 revenue “significantly” above previous year’s figures.

- Renault SA dropped 4.3 percent on concern it may face fines over allegations that its vehicles breached emissions rules and that top management may have been involved in the fraudulent strategy.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.