- Home

- >

- FX Daily Forecasts

- >

- EUR/USD: Mixed signals, possible reverse

EUR/USD: Mixed signals, possible reverse

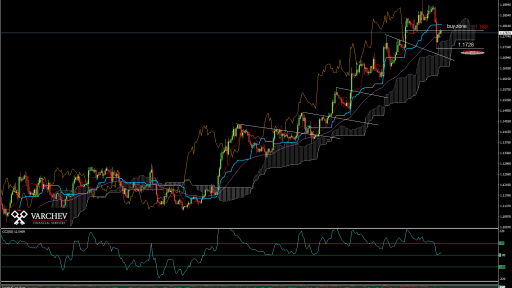

EUR/USD: Mixed signals after the heightened volatility last Friday due to the better than expected economic US data, which can alter the sentiment for the next few days. The rising trend is still on, however, a new long position could be taken only if the price goes above 1.18. The reason for the increased attention is the strong short-term movement, which may signal the end of the dollar depreciation, but of course only if it passes below 1.1728. We leave a buffer zone to adjust the sharp fall from Friday to levels 1.18, an area where everything is possible and the current move from 1.1728 to 1.18 is just a correction. Closing a bar above 1.18 will increase the likelihood of a new upward movement.

Alternative scenario: A breakaway below 1.1728 will give a signal for a possible change in the sentiment and new short positions.

Commentary: The rising stepladder - like movement is still in play, the price is around support levels, the sentiment is still positive.

The only difference is: the corrective declining movement, which was sharp and swift compared to the others. The price is still under 50% correction of the bearish bar, still in the zone for a short-term declining.

Price above Ichimoku cloud and above 50 EMA, possibility for a new increase if the price goes above 1.18.

CCI(50) is above 0, which also shows, the an increase is more likely, however crossing the 0 will change the outlook to sell.

Pin bar on levels around 1.19, negative signal.

Стефан Д. Ангелов - Head of Stocks Trading

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.