- Home

- >

- FX Daily Forecasts

- >

- EUR/USD: Where should Pullbacks Hold? – BofAML

EUR/USD: Where should Pullbacks Hold? - BofAML

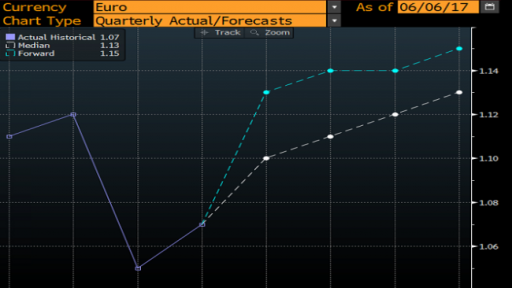

Bank of America Merrill Lynch FX Technical Strategy Research notes EUR/USD remains rage-bound in the near-term, but could test upper end of range near 1.14 - 1.14

" A tactical YTD upside breakout on EURUSD (price of 1 EUR in USD) above 1.0829-1.0906 suggest near-term upside potential to the 2-year +range highs near 1.1366 to 1.1495.

Pullbacks that hold above last week's low near 1.1110 keeps the trend in favor of a test of the highs. The upper end of the weekly cloud and YTD pattern breakout point at 1.0979-1.0829 provide additonal support," - BofAML argues.

Turning to USD/JPY, BofAML notes that the pair has corected but has plenty of support near the 200-week MA, Fibonacci levels, and weekly Ichimoku cloud support in the 111.16 - 108.84 range.

" In our view, this bullish set-up favors a renewed move higher in USD/JPY toward the downtrend line from mid 2015 and the late-2016/early - 2017 peaks near 116.65 and 118.60 - 118.66, respectively with an eventual move push to the 2015 хигхс нот рулед оут.

Staying above the 111 - 108 range keeps this medium - term view intact," BofAML.

Source of the Graph: Bloomberg Pro Terminal

Senan Fuchedzhiev - Trader

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.