- Home

- >

- Daily Accents

- >

- Expect strong movements at EUR/USD after the ECB meeting today

Expect strong movements at EUR/USD after the ECB meeting today

The previous ECB meeting was a pivotal one (important forecasts and forward guidance were published) and provoked a violent reaction in the foreign exchange market. In particular, the common currency lost 2.5% in response to comments 6 weeks ago. Recalling the meeting in June, it is important to warn traders from forming a position in advance.

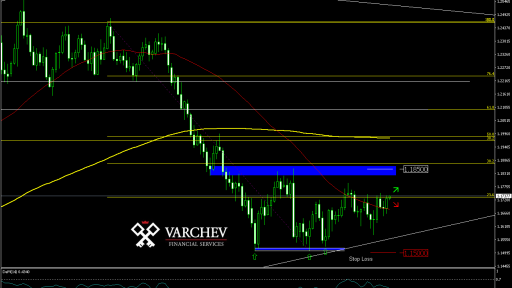

The common currency had been adding for two days before the meeting, and continued to grow immediately after the commentary had been published. And only after the euro flew to the monthly highs near 1.1850, we saw a dramatic turn of the fortune and active sales.

It also would be naïve to believe that if Draghi put pressure for Euro last time, this time he would definitely support it. Besides, it is not worth thinking that the ECB will give up and speak with strong rhetoric (which is positive for the euro) in the light of Trump's remarks that the Eurozone and China's policies contribute to cheapening of their own currencies. Probably, Draghi will have to remind about independence of the ECB again.

At the same time, it should be noted that in the past 6 weeks we received the actual introduction of retaliatory sanctions from the EU, deterioration of business sentiment from ZEW and external trade surplus on the one hand and increasing of the inflationary pressure on the other. However, it should be borne in mind that inflation trends are much easier to predict, and much of the current data is already embedded in market quotes and expectations of market participants.

In my opinion, it is worth paying attention that the German business circles consider the damage caused by trade wars harmful. This is the factor that has yet to affect actual business activity. Such a serious factor of uncertainty will not allow the ECB to speak with a more positive rhetoric than in the middle of last month.

If markets think in a similar way, the positive tone and Draghi's tightening of the rhetoric will be a big surprise for the markets and a powerful supporting factor for the growth of the single currency with the potential of return to the highs of June at 1.1850.

However, it is more likely that the bank will maintain a soft tone in its policy and even greater concern about the uncertainty surrounding the "trade wars" is possible. This position is unlikely to be a pretext to repeat the June collapse, but potentially will be able to cool the fervour of single currency buyers by expanding EUR/USD down from the upper limit of the trading range 1.150-1.1750.

Source: Reuters

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.