- Home

- >

- FX Daily Forecasts

- >

- Expectations for the FX market and where can we look out for profits

Expectations for the FX market and where can we look out for profits

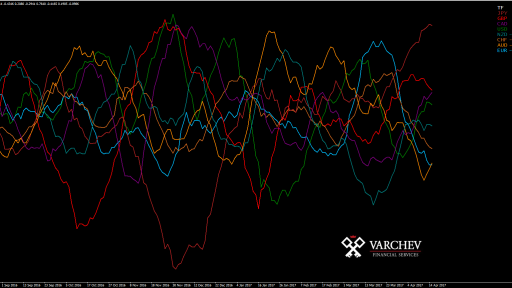

The Slope Indicator shows us the strength of the currencies and the trend towards a weighted formula of all crosses. Currently we observe turning in AUD and EUR for a likely increase. Similarly we see a turning for decline in USD, GBP and JPY. Sentiment for CAD stays positive, and negative for the CHF.

The Dollar makes normal reversal toward decline after comments by the US President on the weekend that the US currency is too strong and this will hinder the economy. This has a positive impact over the EUR, where the political risks are likely included in the price of the single currency.

Better than expected GDP and Industrial Production data from China will support the Australian dollar. The stabilization in the commodities prices and mostly in oil prices are an additional prerequisite to seek long positions in AUD crosses. The most suitable is currently AUDUSD, AUDJPY Long and GBPAUD Short.

We remain long on CAD supported by a series of better than expected data about employment change, and also of course the increase in the price of black gold.

The Swiss franc is going lower, although geopolitical tensions. The demand for safe heavens is concentrated mainly in gold and yen. Currently we can see a slight cooling of tensions after the US said it would not take actions after the unsuccessfully fired missiles from North Korea, but warned of intervention if the tests of nuclear weapons don't stop.

Trader Nikolay Georgiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.