- Home

- >

- Stocks Daily Forecasts

- >

- Facebook is Strong Buy among Wall Street’s top analysts with expectations of 28% growth and an average estimate of $237 per share

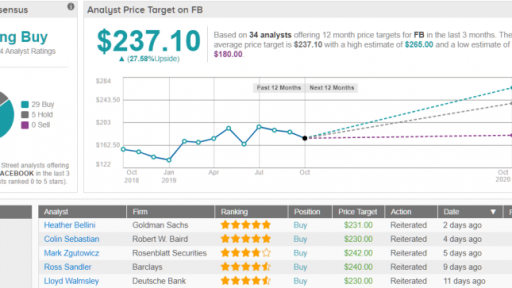

Facebook is Strong Buy among Wall Street's top analysts with expectations of 28% growth and an average estimate of $237 per share

Facebook has been a tear this year — with shares soaring 42% — and analysts say the gains may not be done yet.

Ahead of its upcoming Q3 earnings release, the Street is standing firmly in Facebook’s corner with both Barclays and Deutsche Bank recently publishing bullish calls.

Based on each firm’s channel checks, demand for Facebook ads remains healthy. According to Deutsche Bank’s Lloyd Walmsley, data indicates that there wasn’t any ad spend deceleration from the second quarter and that same client spending improved for FB.

Adding to the good news, Walmsley sees gains in store thanks to Instagram Checkout as well as the company’s focus on monetizing Instagram influencers. Instagram Checkout lets users easily buy products they discover on the social media platform. Its growing number of partners and the addition of new features like alerts is expected to contribute to impressive top-line results in 2020.

Walmsley rates FB stock a Buy along with $230 price target, which implies about 23% upside from current levels.

Similarly, Barclays’ Ross Sandler likes what he’s seeing. “We get the sense that Facebook is starting to come out of the privacy and regulatory fog it has been in the past two years, and get back to a stronger innovation cycle. Management likely paints a scenario of steady deceleration and heavy investment for 2020, but we think Facebook may be the only mega-cap to see margin expansion and rapidly accelerating EPS growth next year,” the analyst explained.

As a result, the 5 star analyst reiterated his Buy rating and $240 price target. He is confident in FB’s ability to surge 29% over the next twelve months.

Overall, Wall Street is clearly bullish on FB. With 7 Buy ratings received from top analysts in just the last 25 days, it’s no wonder the stock has a ‘Strong Buy’ analyst consensus. In general, analysts see 28% upside potential for FB based on its $237 average price target.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.