- Home

- >

- Daily Accents

- >

- Factors that will influence the yuan in 2016

Factors that will influence the yuan in 2016

There are several factors that can affect the yuan over the next 12 months.

Late last year, China announced that it will issue an evaluation of the yuan in three new currency baskets, including one that's a trade-weighted.

"I think everyone is on alert that if the dollar rises considerably further PBOC has the chance to change the evaluation mechanism of the yuan," said Greg Anderson, global head of currency strategy at BMO Capital Markets.

Such a change would likely help the yuan to gradually weaken, protecting investors from global market turmoil that followed the sudden devaluation in August.

Huge current account surplus of China increased through 2015 as the fall in commodity prices reduced the total value of imports. But in the second half of the year was negative capital account and foreign reserves decline. Because capital account reflects the flow of money across borders, probably yuan to continue to move in the same direction as the capital account.

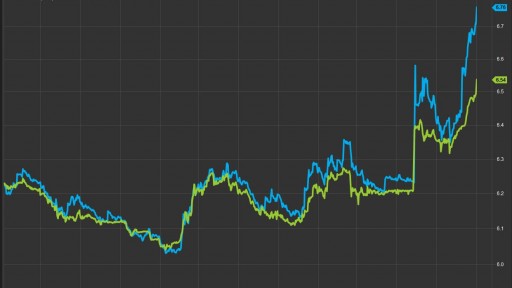

A currency exchange rate two. China wants a weaker currency traders also believe that the currency is overvalued. Proof of this can be seen in the gap between the exchange rates of CHY and CNH, which have rarely been wider

As they prepare for the inclusion of the yuan in the basket of special drawing rights of the International Monetary Fund, traders and market strategists expect China to loosen its grip on the currency.

E.Dimitrov JrTrader

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.