- Home

- >

- Daily Accents

- >

- Fear is becoming a major risk factor

Fear is becoming a major risk factor

Merriam - Webster announced this week that the word "justice" is the word of the year. A woman who can bet everything to "fear" in 2019

This attitude is due to our well-known risky events: The risk of unsuccessful Brexit, the weakening effect of fiscal stimulus in the United States, the uncertainty that fits into the FED's vision of the future, the trade-offs between the US and China, and the impending economic slowdown in China . The yield curve - which historically signaled recessions in passing the short-term interest rates over the long-term, still "flirting" around the point of intersection.

These practical fears can be self-fulfilling: the fact that investors and even households feel that economic growth is a thorn can in itself jeopardize investment and consumption. A risk that economists are increasingly alarming in their forecasts.

"We are beginning to observe a reverse causal link, bad markets are starting to cause a bad foundation." - says Ethan Harris, Head of Global Economics at Bank of America. "The problem is that the economy can suffer a short period of high volatility and political uncertainty, but its patience has limits."

The weakening of the markets may cause the Brexit negotiators to reach a consensus or encourage Donald Trump to find a solution to his trade dispute with China, but according to Harris, while markets are waiting for this de-escalation and release of tension, we will observe a certain period of "talking nonsense."

The prolonged period of economic uncertainty is dangerous because it hides the risks of self-fulfillment. This idea is not new. In 1990, economist Michael Woodford offered the idea that changing expectations for future growth may in the present time delay decision-makers' decisions, which in itself will meet the expectations in question.

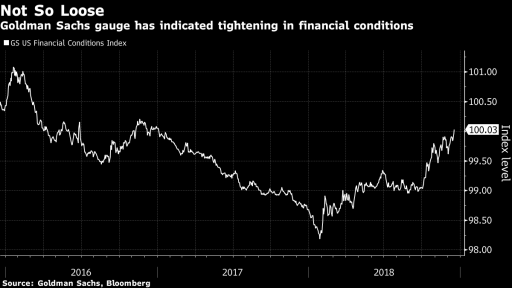

Harris, however, expects tensions along Brexit and the trade war to fall, which will dispel the current storm. However, some economic indicators start to shine in red in Europe and the US, while the Fed is undergoing an increasingly tightening policy. If we have a reduction in tension, it will only be a storm in front of a storm. The real storm, which is yet to come, and now the gloomy clouds begin to hover.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.