- Home

- >

- Market Rumours

- >

- Fed must hike rates to prevent a recession, says Heller, a former Fed Governor

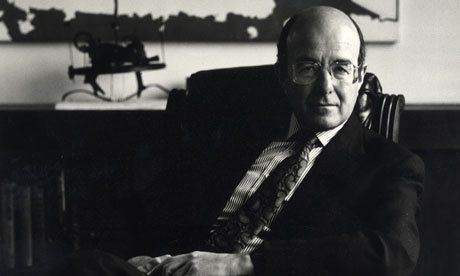

Fed must hike rates to prevent a recession, says Heller, a former Fed Governor

If the Federal Reserve did not start increasing interest rates, that could the cause of the next U.S. recession, former Fed Governor Robert Heller told CNBC.

"There is a very dangerous scenario building up in the U.S. because the rates are so low and for so long," Heller, who was on the Fed's Board of Governors from 1986 to 1989, warned.

His comments to CNBC's "Squawk Box" came after the Fed said on Wednesday that it would keep interest rates unchanged from the current 0.25-0.50 percent. The post-meeting statement also took a more dovish tone, with some indication that the central bank may hike rates only once this year, instead of the two increases previously flagged.

But Heller pointed to increasing risks from the impact of low rates on investment returns.

"Pension funds and insurance companies will sooner or later have a very hard time fulfilling their obligations and that would be definitely triggering the next recession," he said. "When that will happen, when they will run out of money, when they can not fulfill their obligations, nobody really knows, but that may be the trigger for the next big downturn in the U.S."

Heller said he still hoped for two interest rate hikes in 2016, adding that a potential July increase was "still on the table," depending on how data for the current month cames in.

The Fed's more dovish projections come less than two weeks after a Labor Department report showed a 38,000 increase in nonfarm payrolls for May, well below expectations in the 160,000 range.

But Heller, who was formerly the CEO of Visa USA and worked at Fair Isaac, now known as FICO, the consumer credit rating provider, from 1994-2001, wasn't convinced that weaker jobs data should slow the hiking cycle.

"The U.S. had just one bad month of employment data and the Fed is overemphasizing that one bad month," he said.

"Not all that much has changed. Investment has gone down just a little bit in the U.S. economy," Heller added. "The consumer is doing very well. Auto sales are at a very high level. Housing is also performing very well and overall consumer spending is very good. Outside the U.S., also not much changed."

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.