- Home

- >

- Stocks Daily Forecasts

- >

- Five Charts That Say All Is Not Well in Markets

Five Charts That Say All Is Not Well in Markets

A former TV star as U.S. president doesn’t seem to have injected markets with much of a fear factor. But digging beneath the surface of an eight-year bull run exposes subtle signs that hint at an uneasy optimism.

The Dow Jones Industrial Average has sailed past 20,000 and the S&P 500 is nearing its life-time high set in January, indicating that investors have so far shrugged off the uncertainty brought by the new administration.

Here are five charts that suggest all is not well in markets.

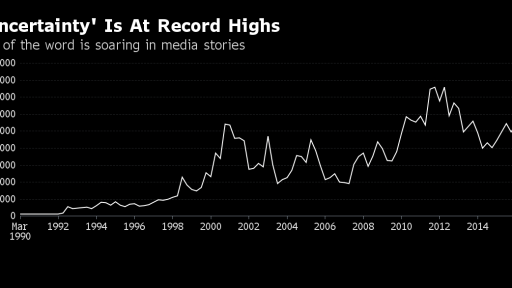

1. By one measure, the world has never been more uncertain

The number of news stories that contain the word "uncertainty" has reached a record, according to Bloomberg data, which include stories published from multiple sources. While President Trump might dismiss such media coverage as biased, other measures of global anxiety are also flashing caution.

2. Wall Street versus Washington

The Chicago Board of Options Exchange Volatility Index, a gauge of investor anxiety known as the VIX, has been unusually calm in recent months, prompting a swell of analyst commentary about Wall Street’s stubborn “fear gauge.” Look to Washington, however, and you’ll find plenty of disquiet among policymakers and politicians. The difference between the VIX and the Global Economic Policy Uncertainty Index is now at its highest level on record.

3. Price of plunge protection

One theory as to why the VIX has been muted recently is that stocks are increasingly moving in different directions under President Trump, suppressing realized correlation and with it, index volatility. Those looking for evidence of market nervousness must look at the CBOE Skew Index, which measures the price of buying protection against more dramatic moves in the S&P 500. On that basis, investors appear to be concerned about tail risks.

4. Money pouring into gold

Like it or loathe it, gold has long been used as a hedge and money has been pouring into exchange-traded funds tracking the precious metal. Again, those inflows have not been matched by movement in the VIX, and a gap has opened up between the two measures.

“While stocks and corporate bonds have rallied year-to-date, we see a very incongruous kind of calm in the markets at present,” Bank of America Corp. Credit Strategist Barnaby Martin wrote in a note to investors. “Note, that while equity volatility is still hovering around record lows, inflows into gold funds year-to-date in Europe have surged.”

5. What to watch out for

Gold may prove the “tell,” according to Chris Flanagan, also at Bank of America. He advises investors to watch “for the combo of rising yields and rising gold prices to signal impending market volatility.” Three consecutive quarters of rising benchmark bond yields and gold prices preceded previous market falls including the 1973-1974 bond market crash and Black Monday in 1987, he says. The yield on the benchmark 10-year U.S. Treasury has risen to 2.44 percent from 1.77 percent since Trump’s election win. Gold has moved sideways.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.