- Home

- >

- Fundamental Analysis

- >

- Five charts that show fear is rearing its head in global markets

Five charts that show fear is rearing its head in global markets

The calm in stocks worldwide is giving way to concern, with Credit Suisse Group AG the latest to raise a red flag for downside risks to markets as the list of economic and political obstacles grows.

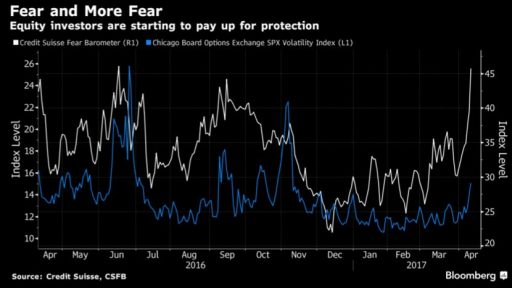

The Credit Suisse Fear Barometer, which measures the cost of buying protection against declines in the S&P 500 Index, neared an all-time high this week. The higher the reading, the more expensive it is to buy protection relative to upside calls, according to Mandy Xu, an equity derivatives strategist at Credit Suisse.

“While put demand has certainly increased over the past week, the biggest mover actually comes from the call-side,” Xu said in a report dated Wednesday. “Falling call skew indicates investors see less potential for market upside going forward, perhaps in recognition of the increased macro and political headwinds.”

Credit Suisse’s gauge jumped 46 percent this month through Tuesday, when it reached 45.74. That’s about a third of an index point away from its June 2016 peak ahead of the Brexit vote. The broader CBOE Volatility Index, known as the VIX, is up almost 30 percent this month.

There’s no shortage of potential concerns. Tensions over North Korea’s nuclear program have intensified days after the U.S. fired missiles at a Syrian airfield. There’s uncertainty over the outcome of the French election, and in Britain doubts are emerging on whether the economy can withstand the political shocks the Brexit negotiations will bring.

Other signs of investor nervousness include:

The rally in global equities has stalled in recent weeks amid growing skepticism about Donald Trump’s ability to carry out promised infrastructure spending and tax reforms after he failed to push through a repeal and replace large parts of the Affordable Care Act. The S&P 500 has lost 2.1 percent since reaching a record on March 1, slipping below its 50-day moving average for the first time since the November U.S. election.

The benchmark 10-year U.S. Treasury is starting to behave as it did in the run-up to the Brexit vote, as yields fall while volatility climbs in one-month options, according to the Merrill Lynch Move Index.

It’s the same story in other major markets. Japanese yields are back near zero after a brief rally through the first quarter of the year, while the gap between German bunds and peers is close to a multi-year low.

Safe-haven trade stand-bys such as gold and the yen are back in vogue. The yellow metal is closing in on $1,300-an-ounce mark for the first time since before Trump’s victory. A four-day winning streak helped it rise above the 200-day moving average this week. The yen also strengthened below 110 per U.S. dollar for the first time since November.

Source: Bloomberg

Junior Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.