- Home

- >

- Stocks Daily Forecasts

- >

- Five Large Cap Stocks that Led the SP500 in the Bull Market

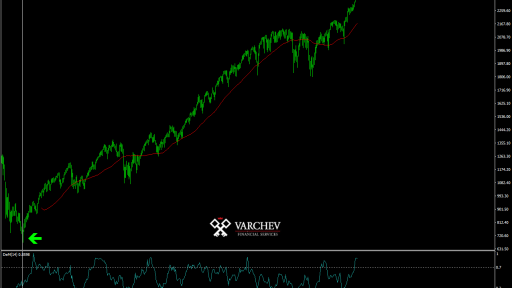

Five Large Cap Stocks that Led the SP500 in the Bull Market

It’s time to celebrate the Bronze Anniversary of the bull run of the S&P 500 index. The recovery for the index from the floor it touched on Mar 9, 2009 has lasted eight years. The index has come a long way, walking on the bullish path, from the rock bottom it touched on Mar 9, 2009. Eight years ago, the S&P 500 touched the bottom mark of 677 after plummeting almost 57% from the peak it reached on Oct 7, 2007.

Here are five solid companies that helped SP500 to climb to levels that we see today.

Netflix Inc.

Founded in 1997 and headquartered in Los Gatos, CA, Netflix Inc. NFLX is a provider of Internet television (streaming services) and DVD–rental services. Netflix streams movies and television shows to both domestic and international subscribers who can watch them on a host of devices including television sets, computers and mobile devices.

The company with a Zacks Rank #2 has jumped 2401.2% over the last eight-year span. Netflix also beat the Zacks Consensus Estimate in each of the last four quarters with an average positive earnings surprise of 141.35%.

Broadcom Limited

Broadcom Limited AVGO is a premier designer, developer and global supplier of a broad range of semiconductor devices. It focuses on complex digital and mixed signal complementary metal oxide semiconductor (CMOS) based devices and analog III-V based products.

The company skyrocketed almost 1240% and sports a Zacks Rank #1. On top of that, Broadcom surpassed the Zacks Consensus Estimate in all the last four quarters with an average positive earnings surprise of 5.95%.

Southwest Airlines Co.

Based in Dallas, TX, Southwest Airlines Co. LUV is a passenger airline that provides scheduled air transportation in the United States. It primarily provides short-haul, high frequency, point-to-point and low-fare services.

Southwest Airlines surged 900.5% during the bull run and carries a Zacks Rank #2. The company managed to beat the Zacks Consensus Estimate in three of the last four quarters with an average positive earnings surprise of 3.81%.

Electronic Arts Inc.

Founded in 1982 and headquartered in Redwood City, CA, Electronic Arts Inc. EA is a leading developer, marketer, publisher and distributor of interactive games (video game software and content).

Electronic Arts improved 405% and carries a Zacks Rank #2. The company delivered an average positive earnings surprise of 32.94% after outpacing the Zacks Consensus Estimate in each of the prior four quarters.

Activision Blizzard Inc.

Based in Santa Monica, CA, Activision Blizzard Inc. ATVI is a leading developer and publisher of console and online games.

Activision Blizzard with a Zacks Rank #2 rose 396% over the last eight years. The firm toped the Zacks Consensus Estimate in all the previous four quarters to deliver an average positive earnings surprise of 33.88%.

Yahoo Finance

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.