- Home

- >

- Commodities Daily Forecasts

- >

- Five myths that will break your perceptions of gold

Five myths that will break your perceptions of gold

In the last year, when investors saw a bunch of stock market corrections, a dollar depreciation, threats from North Korea, the Middle East war to the war that broke out, gold seemed to have the best prospects for rise. Alas, the precious metal wiped out over 15% of its value.

Why? A large number of retail investors are asking, against the backdrop of rising geopolitical and economic uncertainty.

We will look at five golden myths, the exclusion of which will lead to an understanding of the current downturn.

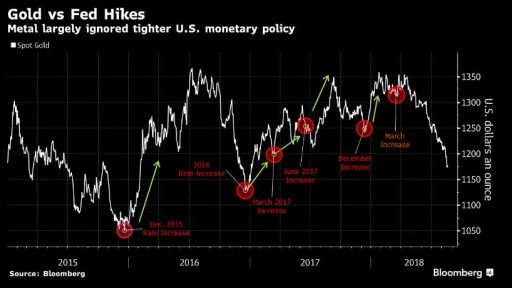

1. Fed's interest rate rise leads to a decrease in gold

This is a totally misunderstanding that makes statistics down and down. Let's look at the chart below.

The key engine of gold is actually the dollar. Few assets have stronger feedback with the Bloomberg Dollar Spot index. The 120-day correlation is -0.6, indicating that the metal and the currency usually move in the opposite direction. Other assets, which are valued in dollars, especially goods, also have reverse correlations, but gold is the strongest.

2. Dow falls, gold grows! Is it?

As an asset considered Safe Haven, gold is expected to rise when indices are declining, right? Not exactly. The correlation between the price index and the indexes is tilting to zero ... exactly 0.03 over the last decade. The attractiveness of gold like Safe Haven has sharply declined in favor of the return ETF's, which offer much better yields during uncertainty.

3. The physical market does not matter

Another assumption is that consumers of natural metal, such as coin, jewelry, and industrial buyers, have little influence on the price. After all, gold is a tradable asset whose price movement is dictated by demand in the real economy. The chart below shows the sharp decline in gold in India, which is the second largest user of physical gold in the world.

As a result of this and many other reasons, the precious metal started its downward trend at the beginning of the year.

4. ETFs have no influence

Exchange traded funds that trade in gold can have an extraordinary impact on the broader market. Exchange-traded funds hold the equivalent of nearly two-thirds of the world's output. Such a volume can not dictate the mood of the gold market. The graph below demonstrates it.

5. Central banks sell gold to prevent crises

Finally, the question arises whether gold sales can come to the aid of countries with external pressure on liquidity. For years, various episodes of financial turmoil in the emerging markets and even in southern Europe have prompted speculation that there may be an emerging sale of gold held by central bankers. Rarely, however, this works this way. Large sales risk the markets to cause global markets to fall, and this would further aggravate the situation.

By actively investing in gold, it is advisable to take into account the above lines and to abstain from the myths surrounding the market, which inevitably lead to losses for a large number of traders, especially for beginners.

Source: Bloomberg Finance L.P.

Chart: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.