- Home

- >

- Stocks Daily Forecasts

- >

- Five shares that we look in October

Five shares that we look in October

US stocks are again traded on green territory after the Fed has raised interest rates by 0.25% and plans another one at the end of December. In support of the indices, the iron-state US economy is visible - inflation remains at "healthy" levels, and the labor market continues to score ever better.

Investors also do not seem embarrassed by the fact that we are celebrating the 10th anniversary of the global financial crisis in 2008, when things really went wrong very quickly. Neither do they seem concerned about the fact that September and October are two of the weakest months of the year for the stock as a whole. Historically, however, shares in the consumer, technology and industrial sectors have performed best at this time of year.

Here are 5 assets to look at in October:

GoPro - GPRO

GoPro (NASDAQ: GPRO) shares rose the upper limit of a multi-month consolidation period after shares were upgraded and Buy Buy from analysts. This comes as a result of the positive steps management has taken to implement a strategy for purposeful sales improvement. GoPro shares also enjoy "golden crossing" in August - the first such move since the end of 2017

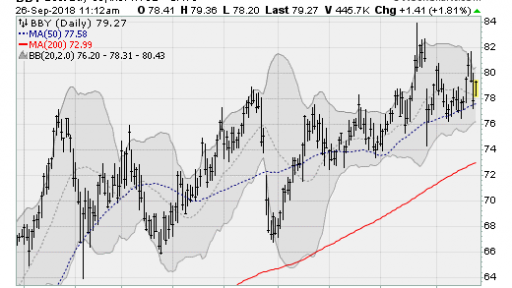

Best Buy - BBY

Best Buy shares (NYSE: BBY) move above support and close to their 50-day average, putting the price above the January range. Shares take advantage of indications that consumer confidence and a strong labor market boost purchases of things like TVs and home theater systems.

Six Flags - SIX

If consumers have more money in their pockets, they are more likely to do fun things like visits to theme parks. After all, SIX shares are returning to their record highs and a new breakthrough over $ 72 per share. The company manages to keep the ruthless upward trend that has been traded since its first IPO in 2010.

IBM

After the double bottom and breaks over the 200-year period it is certain that the corrective movement from the beginning of the year is over. The company recently took advantage of the UBS analysts' update of the belief that the market is unrealistic and does not add value to the company's hardware business. IBM seeks a share price of $ 180 per share, making the company extremely attractive to buyers of underestimated stocks.

Nokia - NOK

With a new focus on corporate networking solutions, the company is exposed to the expected increase in capital spending as the corporate sector aims to increase investment and increase productivity after years of focusing on dividends and redeeming shares. Shares were backed by Credit Suisse analysts via the Buy recommendation.

Charts: Yahoo Finance

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.