- Home

- >

- FX Daily Forecasts

- >

- Forecast GBP / USD in 2017

Forecast GBP / USD in 2017

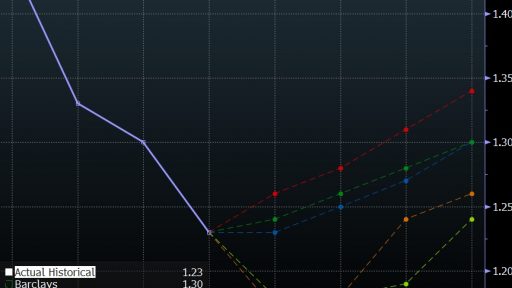

On the chart we can see clearly what are the forecasts of the major banks for the development of the currency pair GBP / USD. Expectations of five of the best investment banks in the world, Barclays, J.P. Morgan Chase, Lloyds Bank, Morgan Stnaley and Saxo Bank are optimistic about the currency pair. Two of them even see an increase in the currency pair at the end of the first quarter.

1. Barclays - the bank forecast the development of the currency pair to continue up to the end of the first quarter to reach levels of 1.2450. The Bank expects steady growth throughout the year at the end of the first half saw the couple at a level of 1.2550 at the end of Q3 - 1.2750 and 1.300 at the end of 2017.

2. J.P. Morgan Chase - From J.P. Expected decline in the first quarter to 1.1800 price, then consolidation by the end of the first half and again price of 1.1800. For the third quarter the bank expected a slight increase to 1.1900 and then strong growth to 1.24 by the end of the year.

3. Lloyds bank - Lloyds of expected price levels to consolidate around 1.2300 by the end of the first quarter and then the price to take up by the end of the first half expecting the rate to reach 1.2500. At the end of the third quarter the bank expects a rate of 1.2700, while the year-end rate of 1.3000.

4. Morgan Stanley - by Morgan Stanley are the most pessimistic in the first quarter and expect the exchange rate of the currency pair to the end to reach the level of 1.1700. Then by the end of the first half as they expect weak growth to 1.1800. The bank saw third quarter with the strongest of the year expected rate of 1.1800 to reach 1.2450. Then by the end of the year rose to 1.2600.

5. Saxo Bnak - By Saxo Bank are the most optimistic about the development of the currency pair and believe that by the end of the first quarter it will reach the level of 1.2600. By the end of the first half the bank predicted rate of 1.2800. At the end of the third quarter is expected the pair to reach 1.3100 levels. By the end of the year the bank expects the rate to reach 1.3400.

Currently GBP / USD is trading at levels of 1.2453.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.