- Home

- >

- FX Daily Forecasts

- >

- Forex: EUR/JPY on key levels

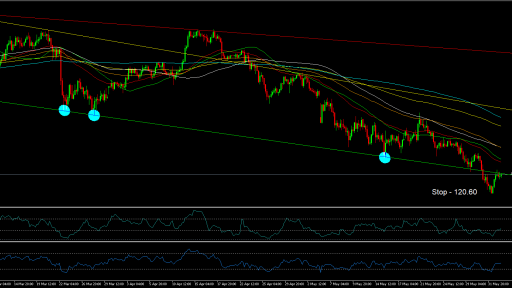

Forex: EUR/JPY on key levels

EUR/JPY

Time frame: H4

Technical analysis: For a long time, the price of the currency was moving in a downward trend, and in the last few weeks she constantly attacked the channel's support without being able to break it. On the last day of the month, she broke down the strong support and made a new bottom at a price of 120.77. After making the bottom, the price went north, and now it's back to the broken support. If the price can get back into the channel and confirm through price action that the trend line again plays a role of support, then we can make a buy order. There are also several places where we could get our profit. The first place is when reaching the yellow trend line. If the price can break through this resistance then it will go towards the upper strong resistance (the green trend line).

Indicators: RSI and DeM are coming out of their over-sold values, which supports the buy scenario.

At this stage all drifting average (50,100,200) EMA and SMA play a role of resistance.

Entry into a deal: If the price of a 4-hour chart closes with a break above the trend line we can go into a "buy" order.

SL: 120.60

Alternative Scenario: If the price fails to break the trend line and keep it below it. Then we can see a drop back to the current bottom. If the price fails to break it and make a price action to indicate that the bottom is strong, we can buy it from there.

Trader Milko Zashev

Trader Milko Zashev Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.