- Home

- >

- Trading University

- >

- Forex hedge strategy “Sure-Fire”

Forex hedge strategy "Sure-Fire"

Forex hedge strategy “Sure-fire”

If you look at the chart and identify what is the trend than this strategy can benefit you a lot. Make sure to use proper position sizing and money management with this strategy.

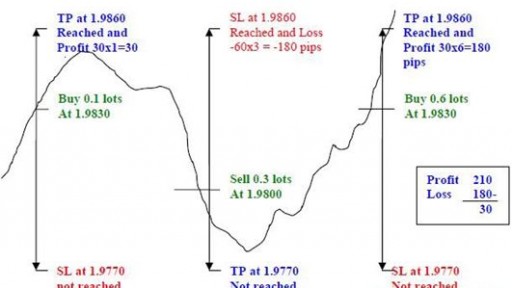

1. To keep things simple, let's assume there is no spread. Open a position in any direction you like. Example: Buy 0.1 lots at 1.9830. A few seconds after placing your Buy order, place a Sell Stop order for 0.3 lots at 1.9800. Look at the Lots...<

2. If the TP at 1.9860 is not reached, and the price goes down and reaches the SL or TP at 1.9770. Then, you have a profit of 30 pips because the Sell Stop had become an active Sell Order (Short) earlier in the move at 0.3 lots.

3. But if the TP and SL at 1.9770 are not reached and the price goes up again, you have to put a Buy Stop order in place at 1.9830 in anticipation of a rise. At the time the Sell Stop was reached and became an active order to Sell 0.3 lots (picture above), you have to immediately place a Buy Stop order for 0.6 lots at 1.9830 (picture below).

4. If the price goes up and hits the SL or TP at 1.9860, then you also have a profit of 30 pips.

5. If the price goes down again without reaching any TP, then continue anticipating with a Sell Stop order for 1.2 lots, then a Buy Stop order for 2.4 lots, etc... Continue this sequence until you make a profit. Lots: 0.1, 0.3, 0.6, 1.2, 2.4, 4.8, 9.6, 19.2 and 38.4.

6. In this example, I've used a 30/60/30 configuration (TP 30 pips, SL 60 pips and Hedging Distance of 30 pips). You can also try 15/30/15, 60/120/60. Also, you can try to maximize profits by testing 30/60/15 or 60/120/30 configurations.

7. Now, considering the spread, choose a pair with a tight spread like EUR/USD. Usually the spread is only around 2 pips. The tighter the spread, the more likely you will win. I think this may be a "Never Lose Again Strategy"! Just let the price move to anywhere it likes; you'll still make profits anyway.

You just need to know during which time period the market has enough moves to generate the pips you need. Another important thing is to not end up with too many open buy and sell positions as you may eventually run out of margin.

Comments: The strategy offers very good trading opportunities but you have to deepen it and try it first on a demo account. I would suggest using the H4 and H1 charts to determine in which direction the market is going. Furthermore, I would suggest using the M15 or M30 as your trading and timing window.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.