- Home

- >

- FX Daily Forecasts

- >

- FOREX:Major Support and Resistance 12.02.2018

FOREX:Major Support and Resistance 12.02.2018

EUR/USD -- Pondering next move as pair holds steady near

50% retrace line of January low-high move (1.2227); close above

1.2295 would re-insert topside risks on charts

* 3rd resistance: 1.2368, 13-day MA

* 2nd resistance: 1.2321-29, mid-candle body price, 21-day MA

* 1st resistance: 1.2297, European high

* Spot: 1.2270

* 1st support: 1.2248, daily pivot

* 2nd support: 1.2206, price low

* 3rd support: 1.2165-53, price low, 61.8% Fibonacci of Jan.

low/high

USD/JPY -- Downtrend conditions persist with falling 21-day

MA guiding the bear journey

* 3rd resistance: 110.29-48, price highs

* 2nd resistance: 109.68-78-81, 21-day MA, price high

* 1st resistance: 109.26-31, ichimoku conversion line,

* Spot: 108.72

* 1st support: 108.13-05, pivot s1, price low

* 2nd support: 107.46, pivot s2

* 3rd support: 107.32, price low in 2017

GBP/USD -- Downside bias persists with next down-leg

expected to encounter stronger demand and accumulation interest

near and into 1.3659-13 area; market has retraced 62% of January

low-high

* 3rd resistance: 1.4037, 13-day MA

* 2nd resistance: 1.4918, 200-hour MA

* 1st resistance: 1.3987-94, price high, 21-day MA

* Spot: 1.3855

* 1st support: 1.3765, price low

* 2nd support: 1.3732, pivot s1

* 3rd support: 1.3659, 55-day MA

AUD/USD -- Selling abates with signs of basing activity

against double MA support lines at 0.7770-57; momentum oversold,

which in a rising market represents value

* 3rd resistance: 0.7910, price high

* 2nd resistance: 0.7864, mid open/close price

* 1st resistance: 0.7842, pivot r1

* Spot: 0.7820

* 1st support: 0.7801, daily pivot

* 2nd support: 0.7770-57, 100-, 200-day MAs

* 3rd support: 0.7744, daily cloud top

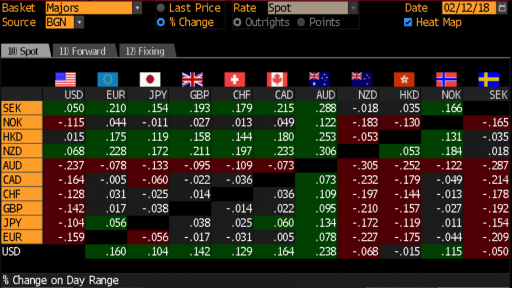

Source Bloomberg Pro Terminal

Trader Velizar Mitov

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.