- Home

- >

- Daily Accents

- >

- French companies are preparing for a possible Le Pen victory

French companies are preparing for a possible Le Pen victory

French companies are stealthily preparing for the worst amid the growing prospect that Marine Le Pen or Jean-Luc Melenchon could win the presidency on platforms of raising trade barriers and potentially exiting the euro currency bloc.

One Paris-based industrial company would consider moving its headquarters to London in the case of a Melenchon win, said its chief executive officer, who asked not to be identified. The CEO of another company, one of the biggest in the benchmark.

CAC-40 Index, said managers are drawing up a Plan B should Le Pen win, though he wouldn’t give details. Aramis Auto, a Paris- based car broker, has made sure it can withstand a retreat by banks.

“We secured our credit lines with our banks a few weeks ago to continue financing the business,” said Guillaume Paoli, the CEO of Aramis, which sells 32,000 cars a year in France with a team of about 30 multilingual buyers purchasing vehicles across the European Union. “It’s difficult to do a checklist of measures to be taken” in the case of a Le Pen or Melenchon victory, he said.

Polls have tightened before Sunday’s first round of voting, making a May 7 runoff between Le Pen of the far-right National Front and the Communist-backed Melenchon a more plausible scenario than it’s ever been. A victory for either one could lead to a plunge in the euro and in French government bonds, hurting banks and insurers that are big owners of sovereign debt. While big French companies that sell internationally would benefit initially from the weaker currency, the prospect of growing protectionism or higher taxes could weigh on businesses and stock prices.

“The economic philosophy of the two candidates is very similar; they’re anti-business,” said Jean-Francois Buet, chairman of FNAIM, an industry group for residential property brokers. “We don’t dare think of a duel between Marine Le Pen and Jean-Luc Melenchon in the second round because that would be a catastrophe in terms of the economy.”

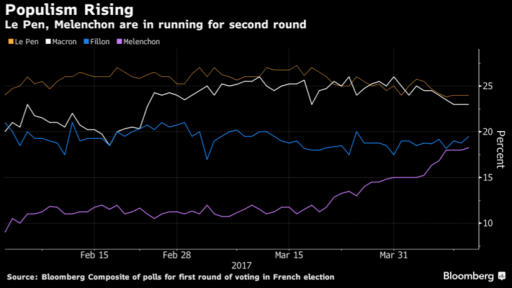

The campaign has turned into a four-way race, with Le Pen and independent Emmanuel Macron running just ahead of Francois Fillon of the center-right Republicans and Melenchon, according to Bloomberg’s composite poll of voting intention.

Opinion surveys show that either of the more business- friendly candidates, Macron or Fillon, would beat Le Pen in the second round, but they also flag that as many as 40 percent of voters remain undecided.

Le Pen proposes withdrawing France from the euro and erecting trade barriers. Melenchon wants to renegotiate European treaties to give France more economic control, with conditions attached to staying in the euro. He would make it harder for companies to fire, limit executive pay and pull out of free- trade deals. He wants to raise the minimum wage and re- nationalize utility companies.

Le Pen’s program would increase public spending by 102 billion euros ($109 billion) a year. Melenchon’s measures would add more than 200 billion euros, compared with less than 20 billion euros for both Macron and Fillon, according to estimates from Institut Montaigne, a Paris-based think tank.

The premium that France pays over Germany to borrow for 10 years has climbed this year as markets priced in Melenchon’s rise in the polls and Le Pen’s persistent strength. The euro has dropped about 5.6 percent against the dollar in the past year.

Ultimately, it may be that just a few entrepreneurs or French companies move elsewhere. After Socialist Francois Mitterrand won office and nationalized banks almost four decades ago, an expected flood of exiles turned out to be a trickle.

Source: Bloomberg

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.