- Home

- >

- Fundamental Analysis

- >

- Fund managers are most bullish on U.S. stocks since 2015

Fund managers are most bullish on U.S. stocks since 2015

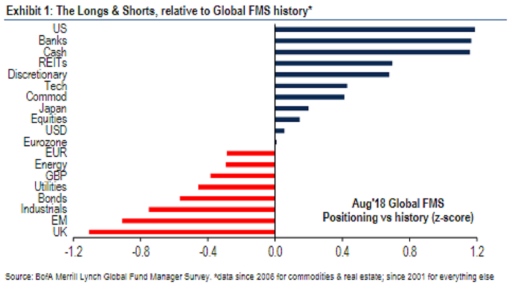

The monthly fund manager survey by BofAML shows the largest positions held by institutional money managers. Some speculators track the survey as a contrarian signal. The idea is that the most crowded positions are most exposed to the risk of a long squeeze: this is because most funds have predetermined losses on each position. This means that a surprising turn in the trend can cause a wave of sell orders on the market. That's the theory. In practice the indicator is not foolproof, and cannot be used for timing a counter-trend position. Despite this we still find the indicator useful in showing the overall positioning in the market, as well as highlighting the positions that are exposed to the largest risk of loss if the trend turns unexpectedly.

This month, allocations to the U.S. jumped 10%, becoming the most popular place to invest in stocks in the world; this is the first time this has happened in five years.

The most crowded position for the seventh consecutive month remains long FAANG (Facebook, Amazon, Apple, Netflix and Google) and long BAT (Baidu, Alibaba, Tencent). The fact that this has been the most crowded position for the seventh consecutive month demonstrates the indicator's key weakness: it cannot be used for timing.

The most crowded short positions are short EM stocks and short Great British stocks.

The survey was conducted between 3rd and 9th of August among 243 investors with $735 billion AUM.

Source: Bloomberg, BofAML

Image: Bloomberg, BofAML

Trader Velizar Mitov

Trader Velizar Mitov If you think, we can improve that section,

please comment. Your oppinion is imortant for us.