- Home

- >

- Fundamental Analysis

- >

- FX Markets sentiment during the European trading session

FX Markets sentiment during the European trading session

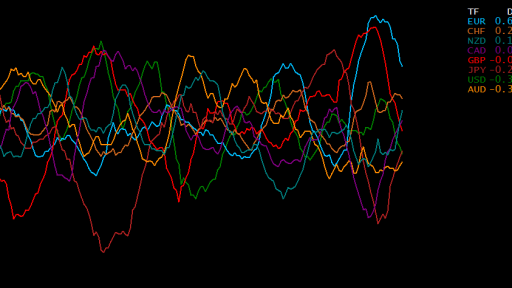

On the chart we can see the Varchev Finance indicator, which tracks the strength of the currencies measuring their movements against each other. As of now, we can see correction in the EUR after the serious rising, as the money flows are targeting the risk currencies AUD, NZD and CAD.

The common currency started to correct, and the main reason for that is the uncertainty around Draghi's speech today at 15:45 local time. Investors will remain wary due to the unclarity around the QE program of the ECB. The most important today will be for the investors to understand when ECB will stop buying assets. It is highly possible Draghi to remain dovish and not make a clear sign. We expect higher volatility in EUR's crosses, which we can use to position ourselves against the currency, where the fundamental remains strong for new rises. Merkel's last comments, that the EUR is undervalued are strong support for the common currency.

The strong EUR will affect negatively the USD, where the uncertainties gives us serious grounds for long positions. We expect the FOMC Meeting Minutes of the last Fed Meeting at 21:00 local time and investors should be wary before the release. We remain cautious for new statements and tweets from the new president, which can give strong impulse and direction for the greenback.

The rise in Oil's prices and the expectations for a successful OPEC meeting in Vienna this Thursday are giving a push of the risk-appetite on the markets. The sentiment on the stock markets remain positive and these factors are supporting AUD, NZD and CAD. This tendency is set to remain strong until at least the end of the day and to be boosted by the bell of the US trading session. Today at 17:00 local time we expect BoC's (Bank of Canada) interest rate decision. as the forecast is for no changes at 0.50%. The volatility during the release of the statement can give us good short term correction for new purchases of the loonie, which remains supported by Oil's prices.

On the other side CHF and JPY don't get the investor's confidence, where we can expect the sells to continue.

Trader Nikolay Georgiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.