- Home

- >

- FX Daily Forecasts

- >

- FX traders should prepare for a sharp rise in the dollar

FX traders should prepare for a sharp rise in the dollar

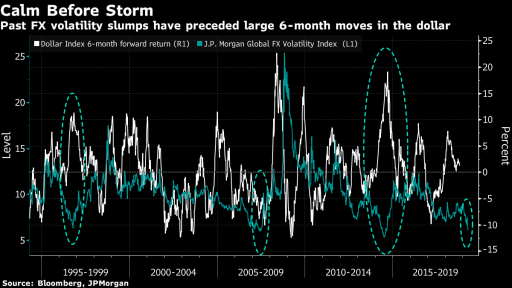

Currency traders will have to prepare for a sharp movement of the US dollar as a benchmark for previous low volatility periods.

Over the past 25 years, there have been three levels of volatility registered by the JPMorgan Global FX Volatility Index. After each floor, the dollar index has made movements within about 10% in a six-month sequence. Currently JP's volatility index is on its five-year low.

"We have seen this market model a couple of times, each time it has preceded a major movement on the dollar." - says Callum Thomas, founder and chief analyst at Topdown Charts. "This is great news for bears and bulls trading in the US dollar, and the only people they will not like are those who still expect the dollar to remain at the end of this year's current narrow range." - adds Thomas.

For example, one of the bottompoints formed in the 1996 index was followed by a 10% rise in green money until the 2014 crash occurred after the dollar climbed by more than 15% within six months. The fall in volatility in 2007 was preceded by a decline in the value of the dollar by more than 10%.

Expected volatility has significantly declined due to the dovish positions of central banks and the rally in risky assets. Still, Morgan Stanley strategists to the Canadian Imperial Ban of Commerce warn that volatility can return to FOREX markets.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.