- Home

- >

- FX Daily Forecasts

- >

- GBP/CAD – Technique and foundation to support short positions

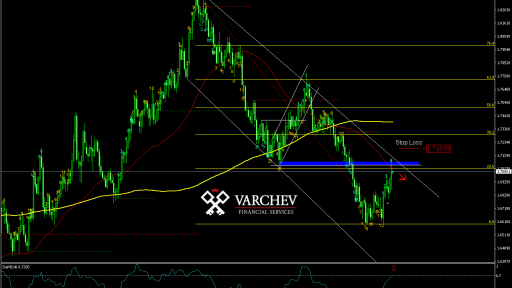

GBP/CAD - Technique and foundation to support short positions

GBP/CAD - D1/H4

Our expectations:

Daily - The price has been on a downward trend since March 2018, with the current correction reaching key levels of resistance. The zone is formed by major downward diagonal, horizontal resistance, dynamic resistance in the face of 50SMA and 23.6% Fibonacci correction of the main trend. DeMarker enters an oversupply area but still does not report Short. Sequential counts 7th of possible 13 - upward impulse is still in effect. The current location of the indicators signals that upward pulses are still possible.

Why Short? From a fundamental perspective, current levels will be very suited to GBP sellers and CAD buyers. On the one hand, the Brexit talks were short, and on the other, it became clear that the US and Canada would most likely agree on NAFTA in the next 24 hours.

H4 will use for more precise positioning.

Given the strong Price Action in the area of resistance I described above, I expect the long-term Short Trend to remain. The sharp withdrawal of the price from the resistance zone clearly indicates that bears take precedence. In addition, Sequential counts 13 on top, and forms an arrow - the end of the corrective movement and the probability of a reversal. DeMarker points down from a surplus zone - negative for the price.

SL: 1.71839

Alternative Scenario: If the price passes and stays above the resistance zone, a negative scenario will break and we are more likely to see an increase in the price of GBP vs. CAD.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.