- Home

- >

- FX Daily Forecasts

- >

- GBP/USD: current levels are key for the pair

GBP/USD: current levels are key for the pair

GBP / USD

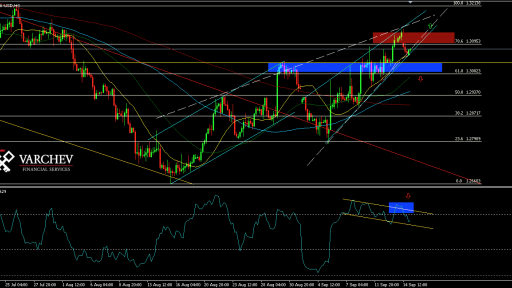

H4 chart

The price is in an ascending channel and above the key level above 1,306-1,307. This level is key for the current upward movement in GBP / USD: the downward trend in GBP/USD is interrupted if the price holds above 1,306-1,307.

However, we expect the current upward movement to be false. The price forms a wedge, pointing to a likely reversal of the short-term upward trend and a continuation of the downward trend. The DeMarker oscillator also points to this scenario. The bearish divergence points to a loss of momentum in the upward impulse. The oscillator forms a double peak (M-form formation) in the overbought zone, then crosses below 0.7. This is a potential downward correction signal.

On a daily chart, the price is locked in the area above the 50-day MA and below the 100-day MA. Therefore, the current price levels are also key to the continuation or upturn of the upward movement.

With arrows, we've marked our strategies for the two probable scenarios.

Falling of the price below 1,303 confirms the scenario that the current upward movement was fake (bullish trap). In this case, we will look for short positions under the psychological key level of about 1.30 at appropriate technical signals.

A break above 1.315 is a sign of a potential twist in the overall trend, and we will look for long positions in such a scenario.

Currently, however, the price is locked in a range support and resistance, and any positions are too risky.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.