- Home

- >

- Fundamental Analysis

- >

- GBP/USD retrace after hitting key resistance level

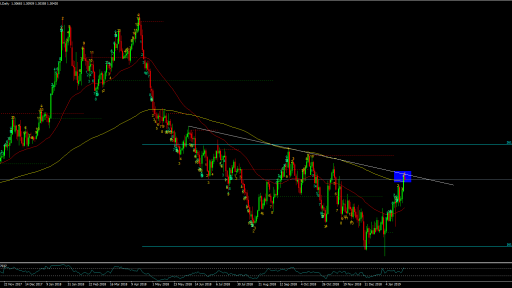

GBP/USD retrace after hitting key resistance level

The high posted earlier today was 1.3094 and price ran into some key resistance levels on the daily chart before backing off now towards the lows. The 200-day MA (blue line) is the most evident as price has not firmly broken above the level since falling below it in May last year. A break and hold above the level would see buyers turn the momentum/bias in the pair to being more bullish.

Just above it around 1.3085 is the trendline resistance stemming from June last year. That is a level that is helping to add a further line of defense for sellers at this point in time. Despite some downside pressure seen in the pound to start the day, dip buyers are notably waiting to pounce nearer to 1.3000.

Markets are seemingly convinced that chances of a no-deal Brexit outcome are diminishing and if the European Union isn't keen on the idea of extending Article 50 or renegotiating the withdrawal agreement, it's looking like a second referendum may be the most likely outcome that will materialise at this point.

The pound is quietly optimistic over the past few weeks and there is good reason for that given how Brexit developments are going.

Given the circumstance, I would expect the key resistance levels here as well as those around 1.3150-75 (November highs) and then 1.3258 (October high) to also play a part in limiting gains. Should cable start seeing a break above the 200-day MA and above the September high of 1.3298, it's not hard to see it running towards 1.3500 and beyond.

But as mentioned, those breaks will likely only come after we see some fresh developments in the Brexit rhetoric; otherwise, it's a case of finding opportunities to fade rallies built on false optimism.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.